Mark Stebnicki/Pexels

This article was first published by RightRisk News.

The COVID-19 pandemic disrupted the world as we once knew it. Even if you have not been directly afflicted with COVID-19, its existence and the uncertainty surrounding it has probably affected your ability to achieve your objectives. This is the definition of risk.

Good managers create strategies for dealing with risk, even something as extreme as a pandemic. Thinking through risk management strategies ahead of time is important because it not only prepares you for the situation, but it decreases the odds of making major mistakes in the heat of the moment. No one expected a pandemic and anyone who tells you they were prepared for one is probably lying. However, many of us expect disruptions as we manage our business. Being prepared to handle disruptions, no matter the source, can pay big dividends.

In recent months, supply chain volatility has impacted the availability and pricing of many inputs for agricultural operations. Fertilizer inputs have more than doubled in price compared to last year, Table 1. The ability to do anything about these prices is limited now but what is your strategy for dealing with it as you plan for the 2022 production year and beyond? Have you implemented that strategy already? If yes, good for you. That means you have probably given this scenario some thought ahead of time and had a strategy mapped out, at least in your head, if not on paper. If you are feeling lost and uncertain about how to handle the situation, we provide some tips below for creating strategies for managing input and supply chain volatility now and into the future.

| Product | 2019 | 2020 | 2021 |

|---|---|---|---|

| Anhydrous ammonia | $494.55 | $493.58 | $1,494.44 |

| Urea 46-0-0 | $380.60 | $366.67 | $912.33 |

| Liquid Nitrogen 28% spread | $238.71 | $222.09 | $579.79 |

| DAP(Diammonium Phosphate 18%N 46%P) | $420.33 | $498.75 | $852.86 |

| MAP (Monoammonium Phosphate 11%N 52%P) | $422.00 | $509.17 | $906.67 |

| Potash (Potassium) | $369.58 | $359.17 | $801.67 |

| Farm Diesel Fuel per gal <1000 gallons | $2.51 | $2.03 | $2.85 |

One risk management tool farmers commonly implement is insurance. Insurance is a transfer mechanism that requires another party outside the operation to provide protection in exchange for a fixed premium. Rarely is an insurance opportunity available to protect against input price and supply chain volatility. Margin insurance products that protect a margin between input and output prices are the only government-backed policies available that would offer some protection for input price volatility.

The other transfer mechanism for managing risk is contracting. Obtaining an input contract for price and quantity prior to any developing volatility can reduce exposure to risk. However, this is a strategy that requires foresight and discipline along with a willing supplier. Table 1 shows relatively stable input prices for 2019 and 2020. A producer willing and able to lock in similar or slightly higher prices for some of these inputs for the 2022 crop back in July when they finished planting their 2021 crops would be in a very desirable position right now. For example, in July 2021, anhydrous ammonia was priced at $726.67 per ton on average in Illinois. At the time, it may have seemed extremely high given prices over the last two years, but it would be less than half the price commanded for the same input today. A strategy to contract delivery of a percentage of your input needs at a known price, well in advance of the growing season, can mitigate risk and provide peace of mind. However, you must be willing to commit to this strategy even when you don’t like the price in order to fully benefit from it and avoid the impact of runaway prices like we see today.

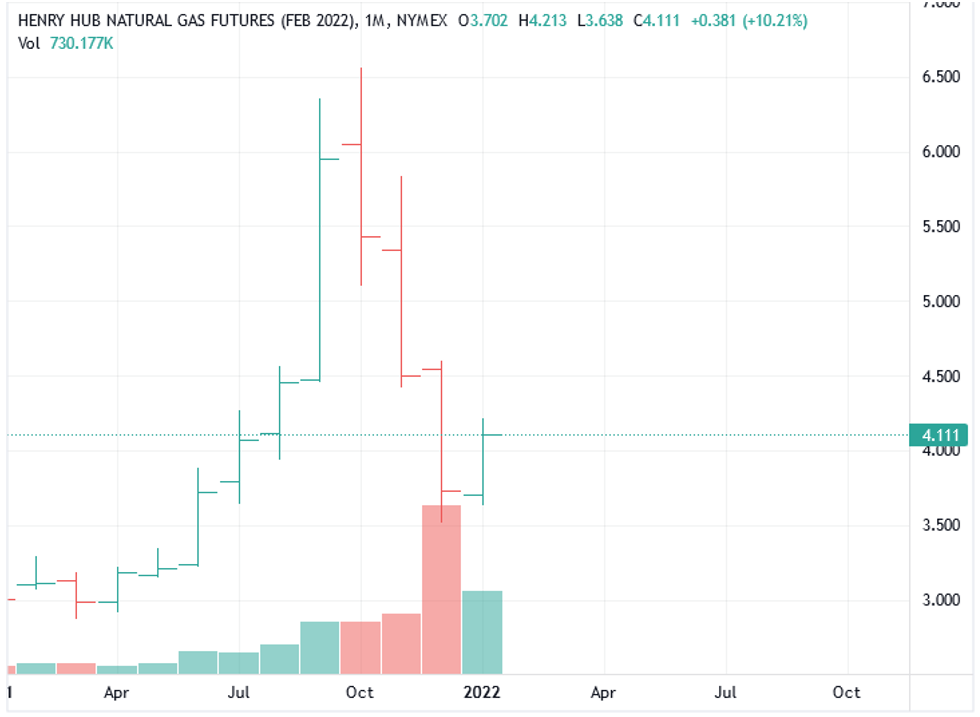

Understanding the reasons for input price and supply chain volatility helps formulate a strategy for dealing with it. For example, one of the main factors driving the increase in fertilizer prices is a surge in natural gas prices, Figure 1. Natural gas is a major input to fertilizer production. In July 2020, the February futures contract for natural gas was trading around $3.80 per million British thermal units (MMBtu). That is not much different than what it is trading for now but, in between, the contract price spiked to over $6.00. That spike had a lot to do with the run up in fertilizer prices. Where it goes from here is anyone’s guess. However, it is important to note the current price for the February 2022 natural gas contract is still well above the $3.00 price it was trading at one year ago. A strategy to monitor natural gas prices as well as fertilizer prices can provide some insight when price protection may be needed. Futures contracting tools for inputs into the manufacture of important inputs like fertilizer does offer an opportunity to hedge some of the price risk with call options.

Figure 1: Natural gas futures price chart for Feb 2022 contract (U.S. dollars per MMBtu).

Published on TradingView.com, Jan. 10, 2022.

In addition to natural gas prices, there are several other factors in play that influence the price of fertilizer. These factors involve international trade disputes, corporate instability, transportation bottlenecks and several other dynamics outside the control of producers. Other strategies are needed to manage risk when transfer mechanisms and ability to control probabilities are limited or non-existent.

Three primary strategies exist for controlling the impact of risk and uncertainty within a farm or ranch operation. One is to maintain reserves. Keeping extra input inventories on hand can help mitigate the risk of input price and supply chain volatility. Investing in storage capacity and stocking up when prices are favorable can, over the long run, mitigate volatility and may even save money. However, this will not always be the case, and it is important to fully account for all the cost associated with implementing such a strategy. For example, storage losses and interest costs add to the purchase price along with handling and additional infrastructure depreciation.

Another strategy for controlling the impact of input price and supply chain volatility is diversification. Working with multiple suppliers is a form of diversification, especially for operating inputs. If one supplier struggles to provide the quantity needed at a price you deem reasonable, it pays to have other suppliers you can turn to as an option. Maintaining good working relationships with multiple suppliers takes time and energy. It is becoming less common as input suppliers consolidate and businesses focus on high volume customers. However, a strategy to consistently maintain good relationships with multiple suppliers for your most important inputs is a strategy likely to pay off at some point.

Diversified crop production and the flexibility to switch between crops are other strategies to handle input price and supply chain volatility. This can affect both the type of inputs needed, as well as the timing and quantity. Having diversified production enterprises is a benefit by itself, but the additional benefit of having the flexibility to move resources between the enterprises increases management options considerably. For example, a producer with the flexibility to move some acres away from a crop that requires a high level of a particular input to a crop that requires a lower quantity mitigates the impact of price and supply chain volatility associated with that input.

Some crop producers are considering the use of livestock manure in response to high fertilizer prices. Manure tends to be high in phosphorus relative to the nitrogen supplied. Given that world demand and phosphorus prices remain high, this may be a good strategy to consider in the present situation.

Finally, it is clearly best to make management decisions with the best information available. Past input quantities may not be the best level to use this year. For example, fertilizer recommendations that maximize yield only maximize profits if the fertilizer is free. As fertilizer prices climb to higher levels, the profit maximizing level of fertilizer decreases accordingly. Alternatively, higher output prices for a crop push the profit maximizing level of fertilizer higher. It is important to understand this tradeoff. Asking tough questions about what the next unit of input will produce in terms of output, what that output will be worth, and what the input will cost is the key to making good input-level decisions. A commitment to stay on top of this information will best inform any strategy you choose to employ.