Fall 2025 Nebraska Farm Income Update

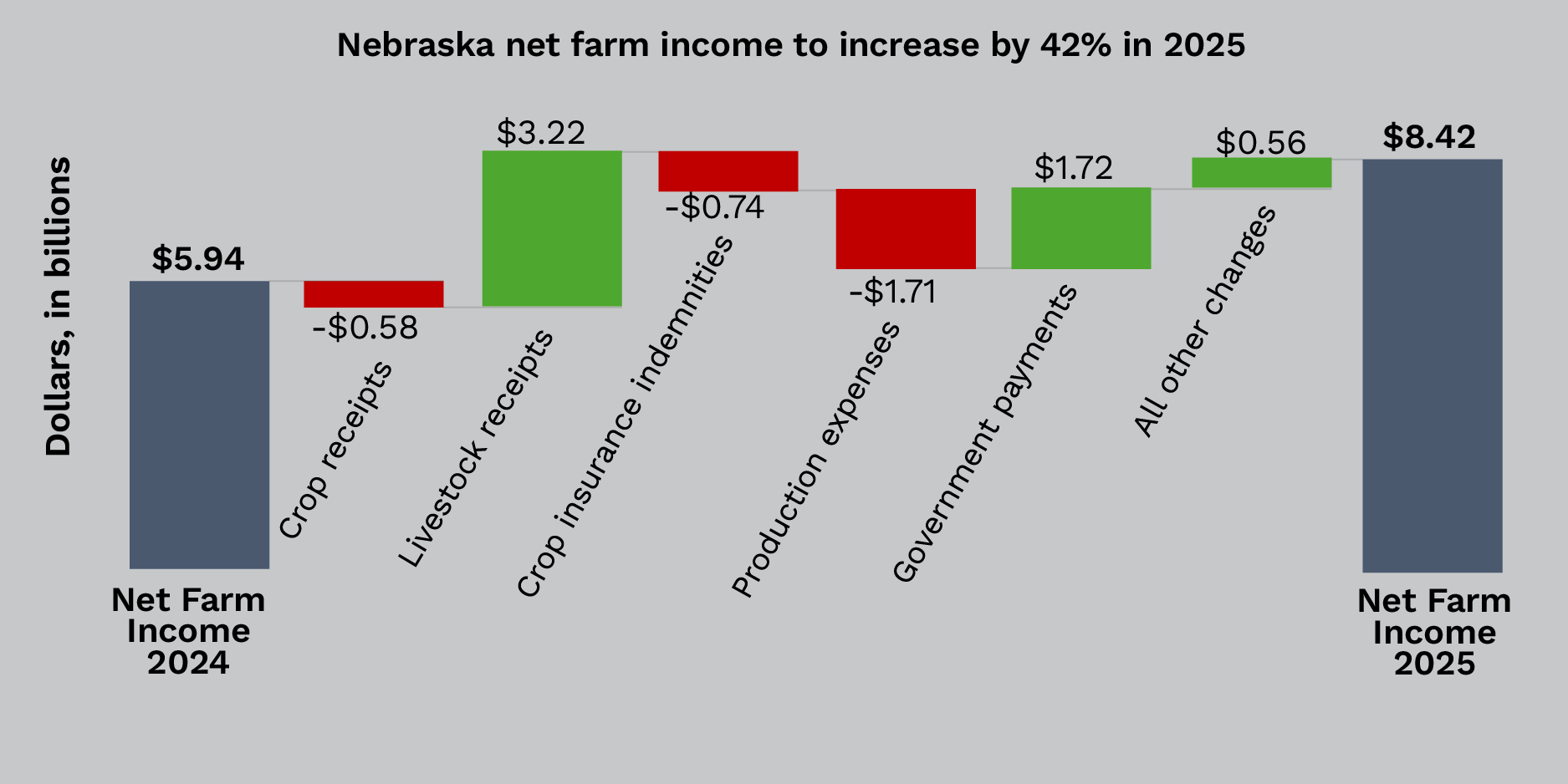

Nebraska net farm income is projected to increase by 42% in 2025, to $8.42 billion, according to the latest projections from the University of Nebraska–Lincoln and the University of Missouri. The Nebraska outlook mirrors the national forecast of a 41% rise in U.S. farm income.

The projected increase of $2.48 billion over 2024 net farm income levels is largely driven by higher livestock receipts and government payments in the state, even as crop receipts continue to decrease, according to the Fall 2025 Nebraska Farm Income Outlook. The report is a collaboration between the Center for Agricultural Profitability at Nebraska and the Rural and Farm Finance Policy Analysis Center at Missouri.

Total farm receipts in the state are expected to increase by $1.85 billion (5%) as the projected $3.22 billion (16%) increase in livestock receipts would more than offset the $576.65 million (5%) decrease in crop receipts.

Nebraska producers are projected to receive more than $2 billion in government payments in 2025, a dramatic increase over 2024. The increase primarily comes from economic and ag disaster assistance payments from the American Relief Act passed in late 2024. The projected payments are based on the amount of assistance distributed to date and the expected remaining payments, although ongoing signups and delays from the federal government shutdown are expected to push some of the remaining payments into 2026. While there has been talk of potential additional assistance for producers for ag trade losses, the projections do not presume any programs or payments unless and until they are approved.

Brad Lubben, an agricultural policy specialist at Nebraska, said government payments are helping to hold up national and state-level income projections while farmers may be experiencing continued tight margins.

“The aggregate outlook for increased farm income in 2025 really hides a divide between ag sectors,” Lubben said. “Beyond higher government payments, livestock receipts are climbing on stronger cattle prices while crop receipts continue to decline with lower corn and soybean prices. The result is a farm economy that looks stronger on paper than many producers may feel in their day-to-day operations.”

The projected 5% decline in 2025 crop receipts to $11.4 billion is the latest drop in what has been a 29% decline since their $16 billion peak in 2022. The report indicates lower corn prices and declines in soybean and wheat production as the main drivers.

The report forecasts cattle receipts to rise 17% to $20.85 billion in 2025, along with modest increases for hog, poultry and egg receipts. Dairy receipts are projected to decline about 5%.

Overall production expenses across Nebraska farms are projected to rise 6% this year to $30.39 billion, a record high attributed to higher feeder cattle prices that are expected to push livestock expenses up 24%. Fertilizer and soil amendment expenses are expected to rise 5%, while fuel and oil expenses are projected to decline by 5% in 2025. Net rent to Nebraska landlords is also projected to decrease 3% this year.

Other key findings from the report include:

- Crop insurance indemnities are projected to decline by 56%, reflecting fewer weather-related losses compared to 2024;

- Corn receipts are projected to decrease by 3% due to a 9% drop in average prices;

- Corn acreage in Nebraska is expected to increase by 700,000 acres (7%) in 2025, while soybean acreage is projected to fall by 450,000 acres (8%);

- Soybean receipts are projected to decrease by 7% in 2025, but higher production levels and prices are expected to rebound in 2026;

- Wheat receipts are forecast to drop 32% in 2025 due to lower production and prices but are projected to rebound in 2026;

- Feed expenses are expected to fall by 8% from last year, offering some cost relief for livestock operations;

- Interest expenses are forecast to decline by 2%;

- Despite strong 2025 projections, Nebraska net farm income is expected to decrease by 1% in 2026 as government payments return to average levels.

“The information in the Farm Income Outlook is intended to inform policymakers, industry analysts and agricultural practitioners about the expected profitability of the local agricultural sector and its main drivers,” said Alejandro Plastina, director of the Rural and Farm Finance Policy Analysis Center at Missouri. “When planning for 2026, it is important for farmers and ranchers to take action to secure sufficient liquidity to operate under sustained tight margins, barring unanticipated new government payments or pent-up demand for agricultural commodities.”

The next Nebraska Farm Income Outlook will be published in the spring.

The full report is available here. Data tables are here.