This article was first published in the May 2024 edition of RightRisk News.

In each of the last two years, RightRisk News has discussed the implications of rising and/or high interest rates on farm decisions (May 2022 and April 2023). As we progress through 2024, the agricultural sector faces significant economic pressures from persistently high borrowing costs.

In the crop sector, smaller cash buffers and the need to preserve working capital due to tightening profit margins resulting from lower crop prices and higher input costs contributed to an increase in farm operating loan activity in the first quarter of 2024 (Kansas City Federal Reserve). Farm machinery and equipment costs also rose considerably in the last few years. As a result, loans to purchase such equipment are larger and the higher interest rates only complicate the purchase decisions even further. Farmers may find themselves prioritizing essential investments in equipment and postponing or scaling back on machinery upgrade and expansion plans.

Furthermore, in the cattle industry, herd liquidation of the last three years due to drought conditions has resulted in high cattle prices coupled with recovery in pasture conditions and a desire to rebuild the beef cow herd. Likewise, as with the machinery and equipment situation for crop producers, a high price tag coupled with high financing rates will likely prolong the rebuilding task for many producers.

Historical Perspectives

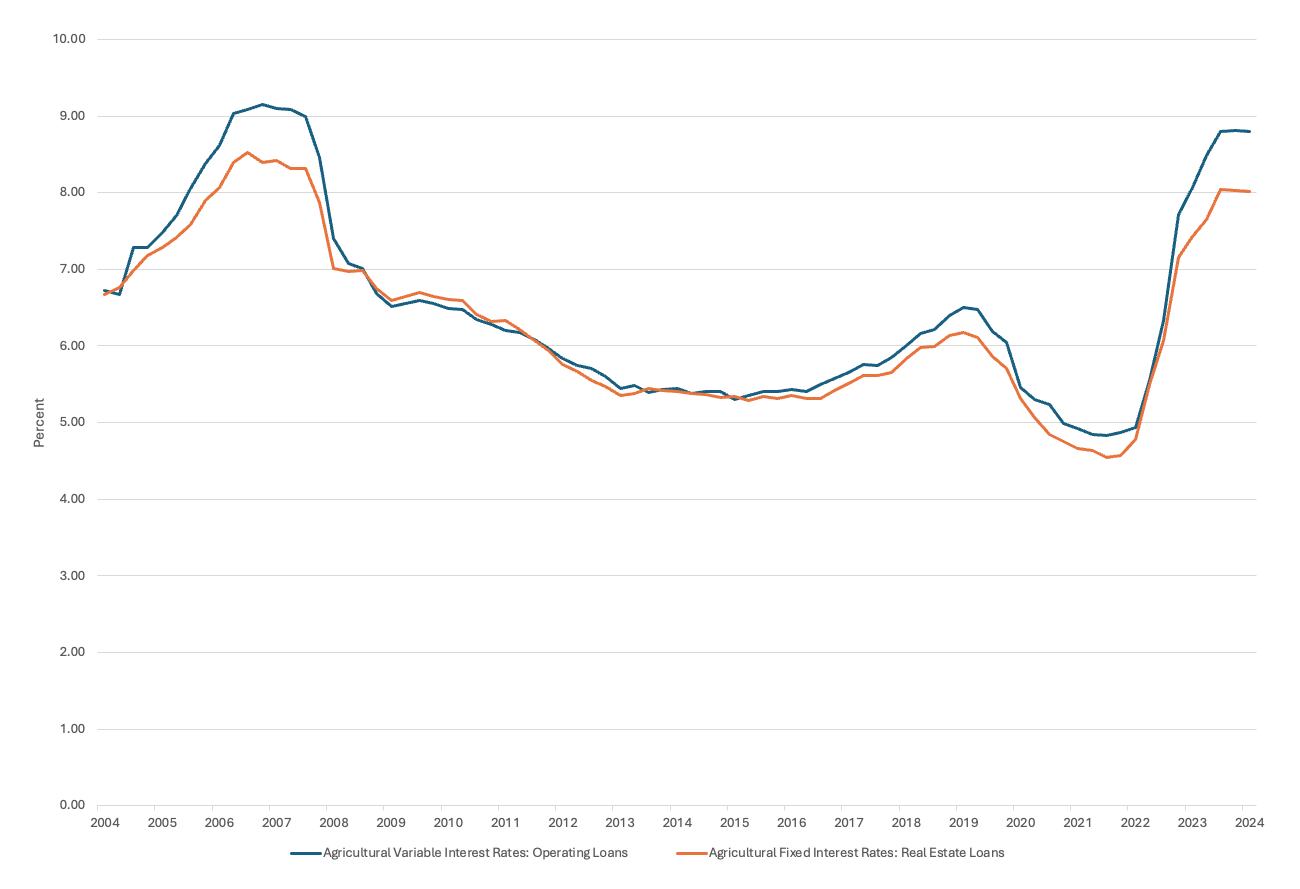

A low interest rate environment persisted for the better part of 14 years from early 2008 through early 2022, with interest rates ranging from 7% down to 4.5%. The Federal Reserve started increasing interest rates two years ago to combat high inflation. Figure 1 shows the average interest rates paid by agricultural producers over 20 years, from the beginning of 2004 through the first quarter of 2024 in the Tenth District of the Federal Reserve Bank. Variable interest rates on operating loans topped out above 9% from mid-2006 through mid-2007. That was followed by the subprime mortgage crisis, which led to the 2008 stock market and housing market crashes. The Federal Reserve reacted to the subsequent Great Recession with unprecedented full percentage point slashes to interest rates to stimulate the economy.

Recent increases in interest rates are dramatic from an historical perspective. However, that is the result of a combination of the current high rates and the historical lows from which we came from only a couple of years ago. Is this type of interest rate volatility common? The short answer is no, but it sure has grabbed people’s attention.

What the next year holds for interest rates will largely be determined by what happens in the economy. The Federal Reserve’s target inflation rate is 2%. The annual inflation rate in April 2022 was 8.3%, and it peaked at 9.1% in June 2022. The Federal Reserve responded by increasing interest rates to get inflation under control. That has worked for the most part, with the current inflation rate hovering in the mid-3% range. However, the persistence in that hovering has frustrated many and resulted in interest rates remaining high to continue the effort to lower inflation to target rate. A soft landing would be nice but at this point there is a lot that is still unknown.

Are Interest Rates the Real Problem?

As the preceding discussion indicates, high interest rates cause problems, but are they the problem? Most business owners desire stability allowing them to earn their competitive advantage through hard work and ingenuity. What agricultural producers, in particular, have seen over the last four years is a lot of instability. The aforementioned drought negatively affected production. The COVID-19 pandemic interrupted marketing channels and supply chains. Government policy reactions over a period of several months drove up the money supply. The result was inflation that we are still dealing with today. Higher costs are the real culprit producers need to stay on top of and manage their way through. Higher interest rates compound the problem and complicate the recovery time, but they are not the primary issue producers should be concerned about in the near future.

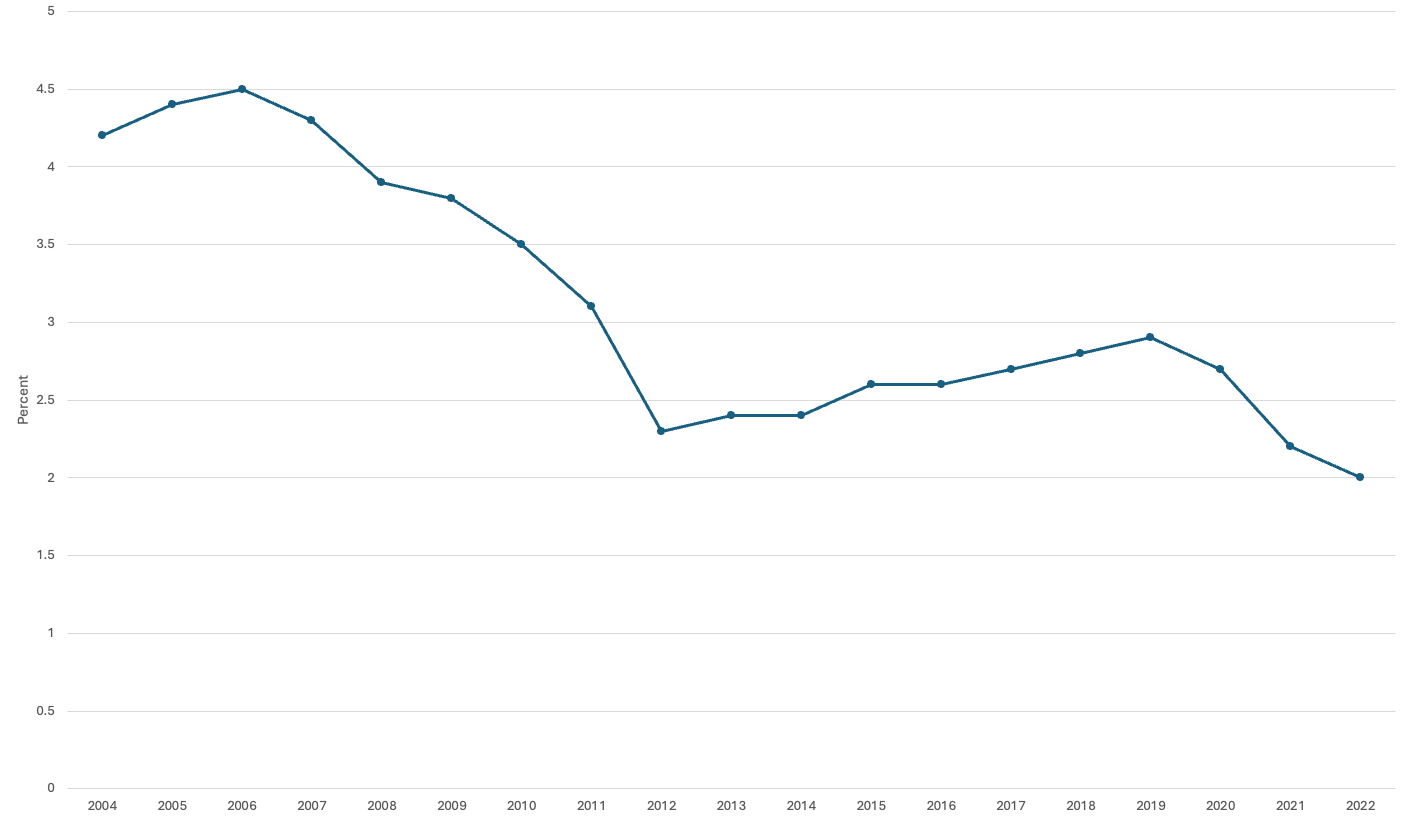

To demonstrate where we are in terms of interest rates versus overall farm expenses, Figure 2 shows the latest data for farm interest expense as a percentage of total farm production expenses. One can see that since 2012, interest expenses as a percentage of total production expenditures have stayed in the range of 2%-3%. In the eight years prior to that, it stayed consistently well above 3%. More importantly, we see in 2022 it dropped to 2%, even as interest rates were rising considerably. This speaks to the offset of increasing production costs that hit hard in 2022. Data is not available yet for the 2023 calendar year but logic and forecasts indicate this ratio of interest expense to total production expense will increase in 2023. However, looking at the past 20 years, it is unlikely that it will spike to anything out of the ordinary.

Summary and Conclusions

Strong cash flow is still king. Liquidity in the agricultural sector has been strong in recent years but increases in production costs, combined with lower revenue projections, may leave some producers with tough decisions to make in 2024 and 2025. Producers who are holding cash reserves in high yielding short-term investments are likely in good shape. Those who rely on short-term financing at variable interest rates to cover a majority of their operating expenses are bearing the brunt of the impact of high interest rates. For those producers, now is the time to focus on controlling expenses as short-term debt can easily turn into long-term problems. In periods of high interest rates, credit-type solutions are not the best option to address liquidity problems. Interest rates are largely a risk that is out of the control of the individual borrower. But interest expenses are a risk they can control with good business decisions, keeping input costs under control, and limiting capital purchases to those with high return on investment.

Figure 1: Average Interest Rates on Agricultural Loans in the Tenth Federal Reserve District*.

Source: https://www.kansascityfed.org/agriculture/ag-credit-survey/.

* The area of the Tenth Federal Reserve District includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico, and the western third of Missouri.

Figure 2: Interest expense as a percentage of total farm production expense – United States

Source: National Agricultural Statistical Service (NASS) – Quick Stats.

Jay Parsons, Risk Management Specialist - University of Nebraska-Lincoln, jparsons4@unl.edu

John Hewlett, Ranch/Farm Management Specialist - University of Wyoming, hewlett@uwyo.edu

Jeff Tranel, Ag and Business Management Specialist - Colorado State University, Jeffrey.Tranel@ColoState.edu