Feeder and fed cattle prices have continued to rise throughout the first part of the year. Reduced cattle supplies and relatively stable beef demand have helped support higher prices. Fed and feeder cattle prices have reached all-time heights, at least nominally. In low inflationary environments comparing nominal prices across time would be less problematic. Contrary to previous sentiments, inflation has not been transitory.

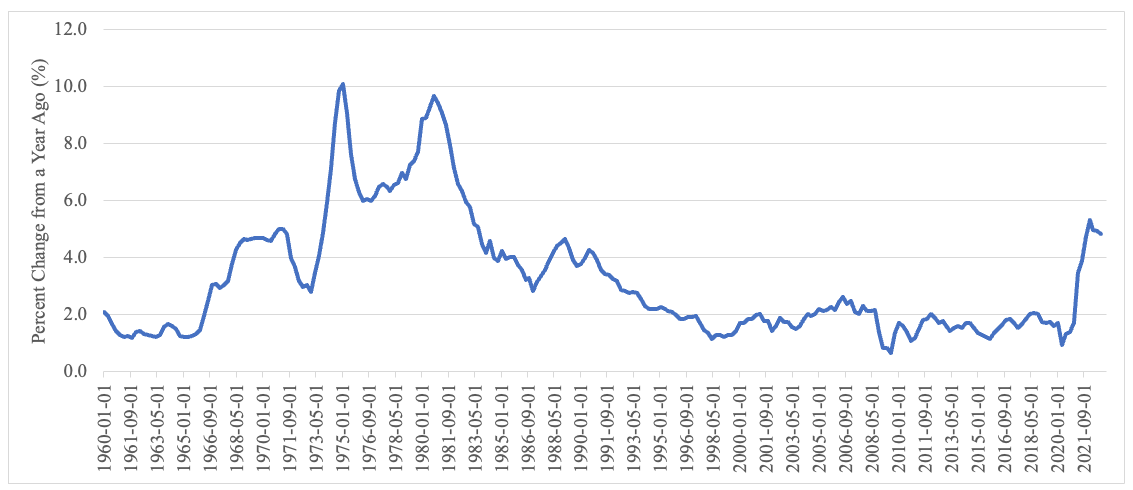

Inflation, as measured by the Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index), has increased significantly in the last three years (see Figure 1) and, thus, comparison across years should be done using real prices — adjusting nominal prices by inflation. Real prices indicate that we have yet to surpass prices producers received for feeder and fed cattle in 2013-2015.

Figure 1. Quarterly Percent Change from a Year Ago in the Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index), 1960-2023

Source: U.S. Federal Reserve – St. Louis (2023); Author's calculations

The impact of interest rate hikes on cattle producers

The Federal Reserve raises interest rates when the economy starts overheating (i.e. too much inflation) and cuts rates when the economy looks weak (i.e. high unemployment). Before Covid-19, the Federal Reserve held the federal funds rate at around 0% and still bought billions of dollars in bonds every month. As inflation began to rise, the Federal Reserve began to raise interest rates, which are then passed down to other banks and ultimately to borrowers.

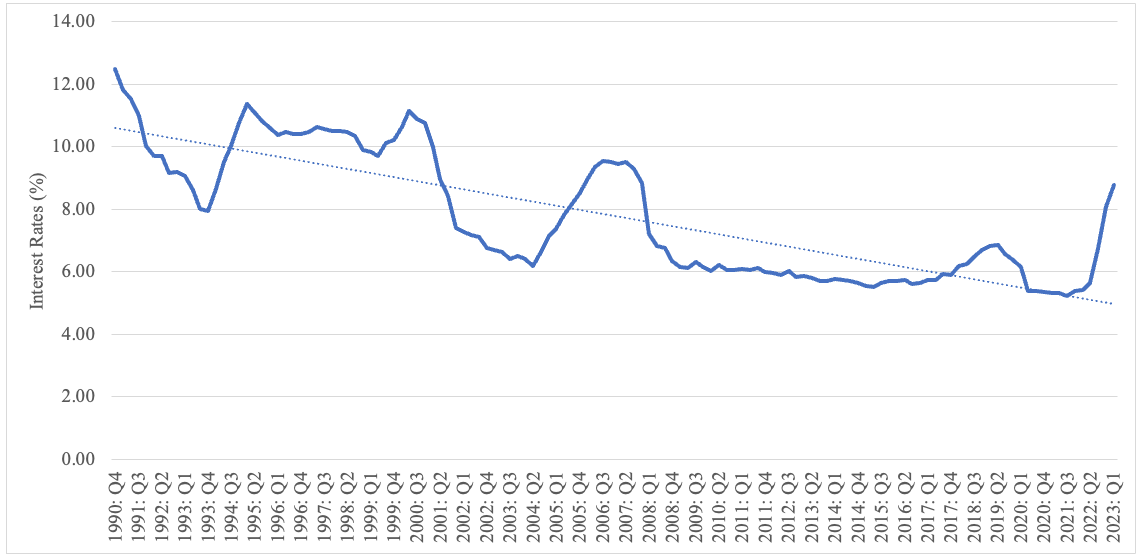

Livestock producers have not been immune to higher rates, but have more recently felt these during this last loan renewal cycle. Feeder cattle interest rates did not begin to rise significantly until the middle of 2022. Rates were around 5.5% in Q2:2022 and have since risen to over 8% (see Figure 2). Similar operating loan rises are present in cropping operations. This is the highest interest rate for feeder cattle since 2008 and unless the Federal Reserve significantly ratches back on raising the funds rate, it could surpass those levels set in 2008.

Figure 2. Quarterly Feeder Cattle Interest Rates (%), 1990-2022

Source: U.S. Federal Reserve - Dallas (2023); Author's calculations

Ultimately, higher interest rates squeeze profit margins and producers will seek to reduce these impacts. Previous studies have found that interest rates reduce feeder cattle prices. On average, a 1% increase in the interest rates would decrease feeder cattle prices by 1.14% (Marsh 2001). Another change could be how long cattle are on feed and weights cattle are placed in feedlots. It is typical for cattle feeders to have loans on the feeder cattle and half the feed. Reducing the number of days on feed by placing heavier cattle would reduce total interest burdens.

Embracing operational efficiency in livestock management

Another way to reduce the impact of higher costs, such as those from higher inflation, is by becoming more efficient in the operation. Efficiency tends to be thought of in terms of animal management and performance. The interest and use of precision livestock management has increased in the last five years ranging from animal health detection such as Cattle Sense © in feedlots and virtual fencing in cow-calf. Many other technologies have been and will be available to producers.

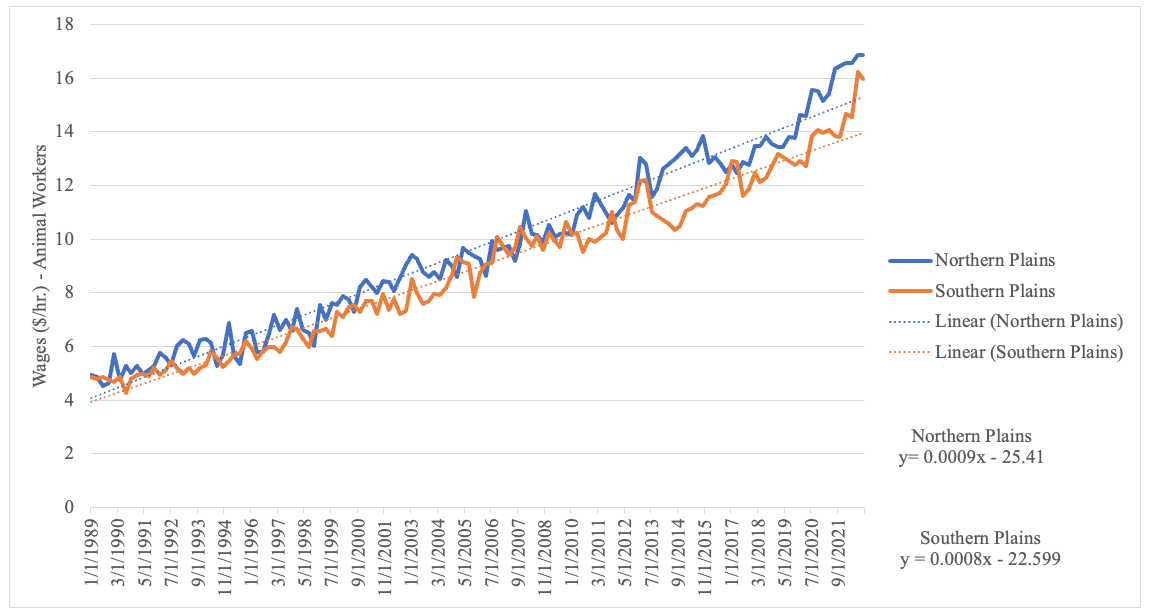

Some technologies will also help in solving long-run concerns about labor. Labor costs have also risen significantly above long-run trends beginning in the middle of 2020 (see Figure 3). This trend holds across different major livestock-feeding regions. The rise in wages is partly due to a limited labor supply in rural areas and field crop and livestock producers competing for a fixed labor supply. Once employees are found, ensuring adequate training and incentives to stay is necessary. In either case, rising costs in finding and keeping good farm labor remain a persistent concern.

Figure 3. Quarterly Animal Worker Wages ($/hr.) in the Northern and Southern Plains, 1989-2022.

Source: USDA-NASS (2023); Author's calculations

Last year, prices began to rise but total profit was limited due to higher feed and supplement/mineral costs. This was true for both cow-calf and feedlot producers. This year, both feeder cattle interest rates and labor costs have risen significantly above the long-term trend lines. Higher labor costs will persist in the coming years but could slowly be replaced with technology. Higher interest rates will persist as long as inflation remains higher. Until it is brought under control, the Federal Reserve will likely not cut interest rates and the cost of raising cattle will be higher. The significant rise in cattle prices along the supply chain has been encouraging. But as in every year, higher prices are nice but wide profit margins are better.

This article was first published by "In the Cattle Markets" on April 25, 2023.

References

Marsh, John M. "US feeder cattle prices: effects of finance and risk, cow-calf and feedlot technologies, and Mexican feeder imports." Journal of Agricultural and Resource Economics (2001): 463-477.

U.S. Federal Reserve – St. Louis. Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index) (2023). https://fred.stlouisfed.org/series/PCEPILFE

U.S. Federal Reserve – Dallas. Historical Feeder Cattle Interest Rates (2023). https://www.dallasfed.org/research/surveys/agsurvey/2021/ag2104