As a graduate student at Texas A&M University during the 1980’s ag crisis, I was involved in a study examining the use of financial management practices by Texas ag producers. Among other things, we learned that 28% of producers never used a balance sheet, 69% never used an enterprise budget and nearly half never used a cash flow budget. We were not able to publish the results of our survey because someone up the administrative or political ladder did not want it to look like ag producers were not doing all they could to help themselves through the ag financial crisis.

After that project, I have often wondered if using these financial management instruments for decision-making would have made any difference in the financial success of those ag producers. There have been a few studies undertaken to examine this question, but to my knowledge, no one has been able to really determine the financial value of these tools.

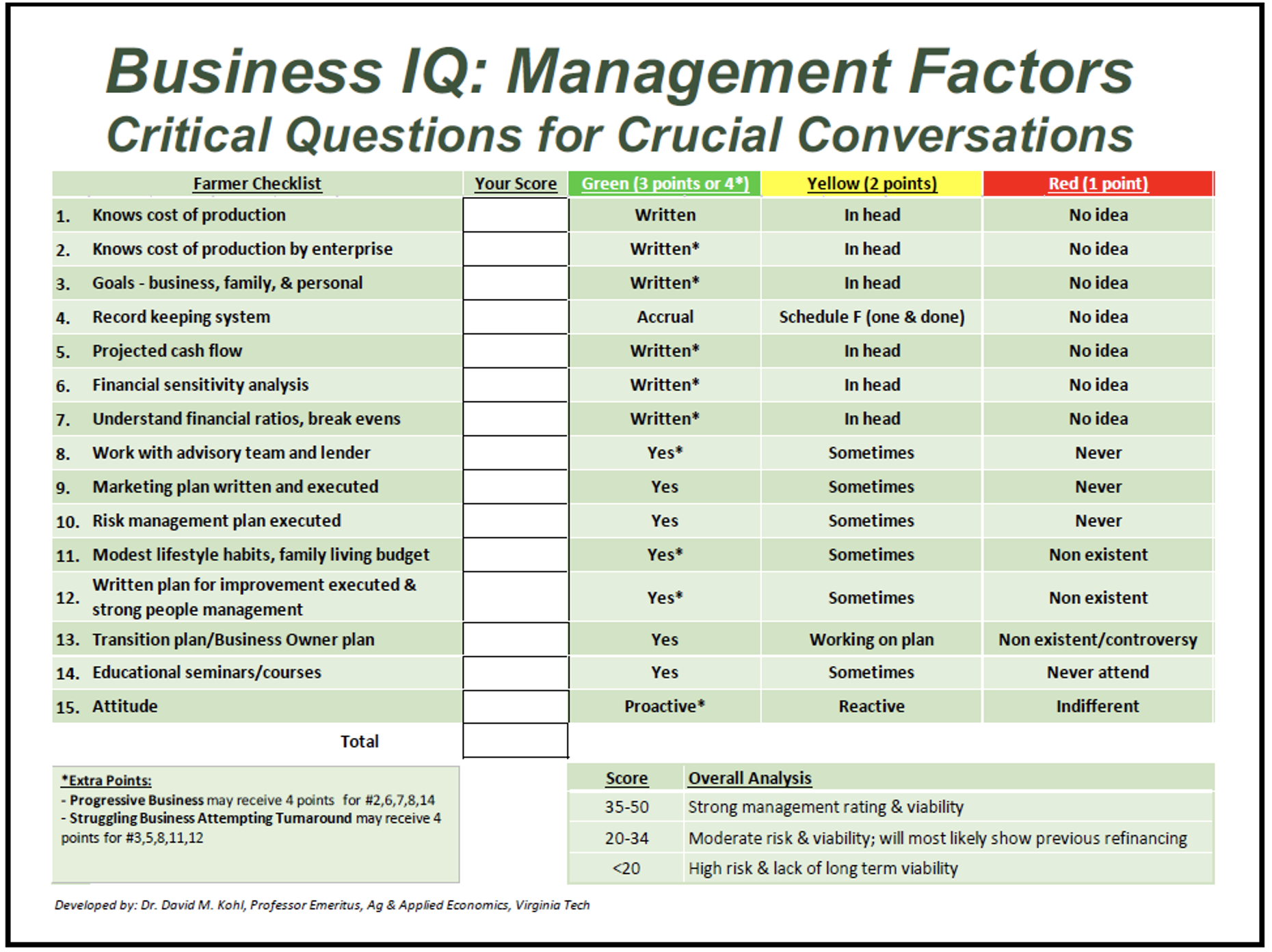

Dr. David Kohl, professor emeritus of Agricultural Finance in the Department of Agricultural and Applied Economics at Virginia Tech University, has persistently taught producer groups that knowing their costs of production, breakeven metrics, and cash flow requirements are key decision-making tools. He developed the adjacent Business IQ questionnaire for producers to rate themselves on their employment of financial management tools.

Dr. Jordan Shockley at the University of Kentucky, and his student, Benjamin Isaacs, administered Dr. Kohl’s survey to a group of farmers participating in the Kentucky Farm Business Management program to see if they could determine a relationship between the producers’ management prowess, as measured by the Business IQ survey, and the financial performance of their farming operation. The debt-to-asset ratio and net farm income were two of the key performance indicators that were found to be significantly correlated with the Business IQ survey.

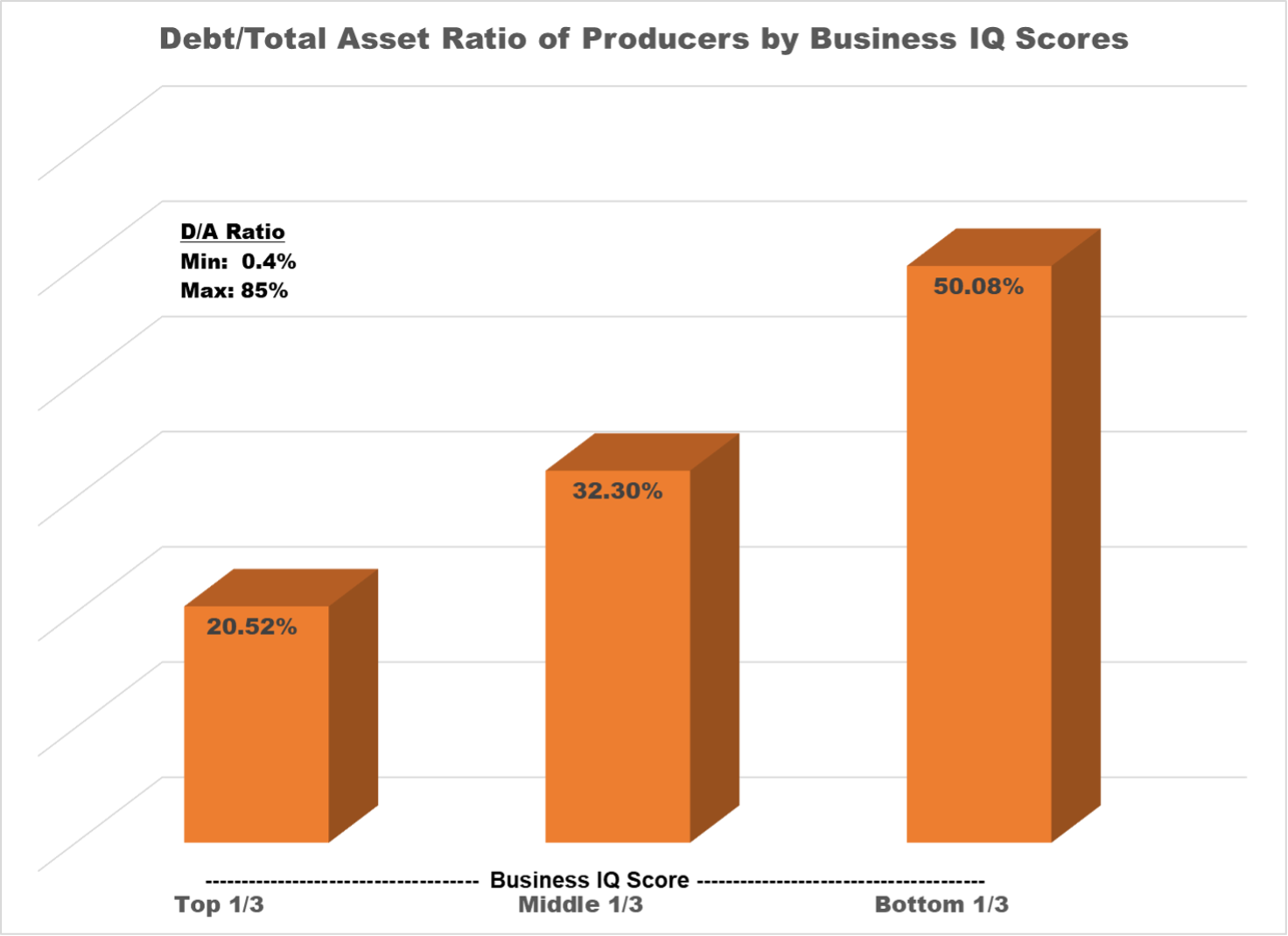

The debt-to-asset ratio is a measure of the solvency of the operation and expresses total farm liabilities as a proportion of total farm assets. The producers who participated in the survey had debt-to-asset ratios ranging from 0.4% to 85%. The one-third of producers who scored highest on the Business IQ survey, had average debt-to-asset ratios of 20.52%, compared a debt-to-asset ratio of 50.08% for the one-third of producers who scored lowest on the Business IQ survey. Many factors could have contributed to the lower average debt-to-asset ratio beyond the Business IQ score, such as the length of time the participants had been farming or the amount of net worth that had been inherited, it is interesting that all things equal, having sound financial management practices was a distinguishing characteristic in having a lower debt-to-asset ratio.

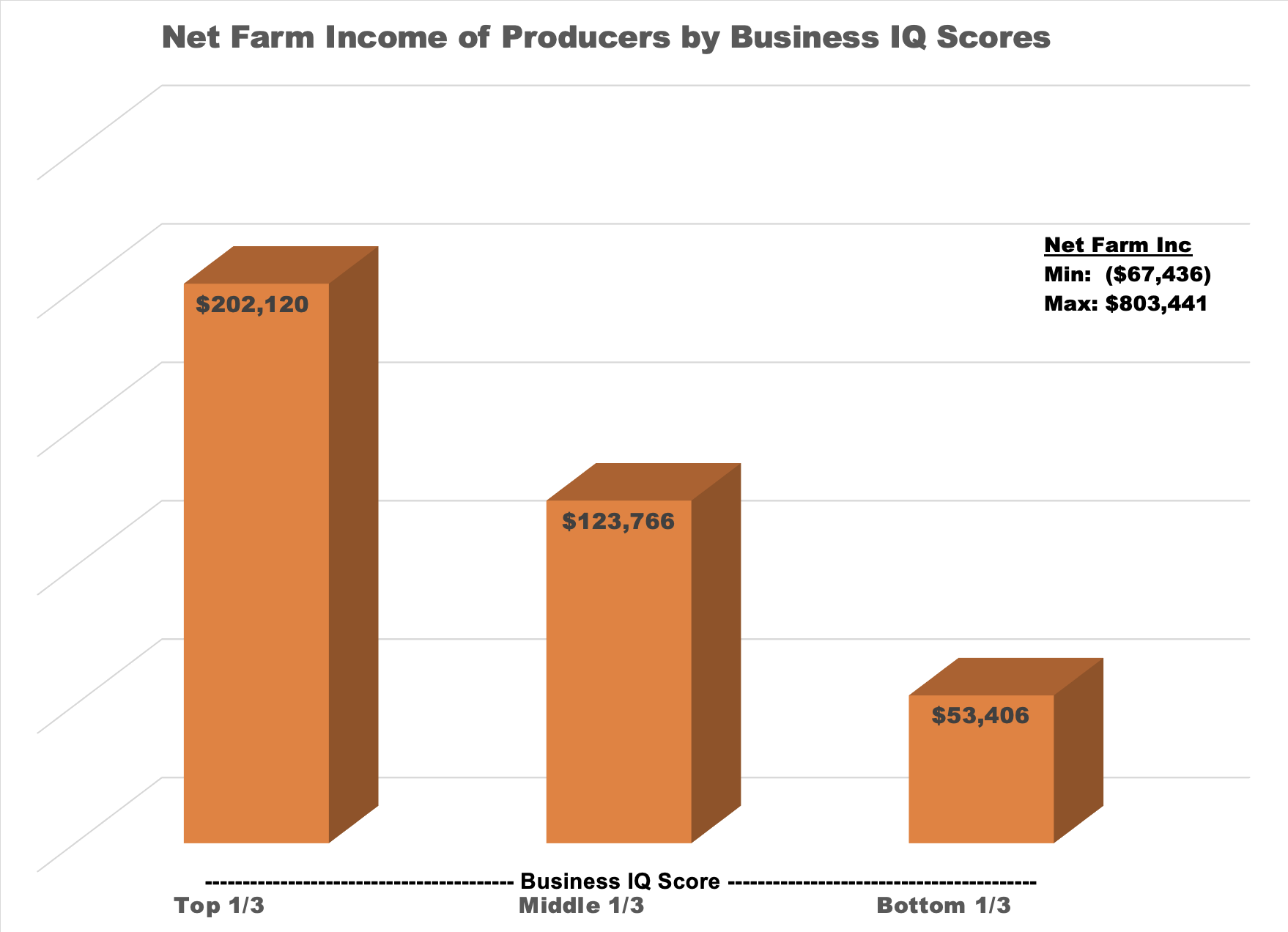

Of greater intrigue is the relationship between the Business IQ scores and net farm income. The one-third of producers who scored highest on the Business IQ survey, had an average net farm income of $202,120 as compared to the middle one-third with a net farm income of $123,766 and the lower one-third with an average net farm income of $53,406. Of course, part of the difference could be the additional interest payment that was netted out of the farm income from the higher debt carried by producers in the middle and bottom one-third of the Business IQ scores. None-the-less, the significantly higher net farm income realized by producers with a higher Business IQ score is interesting. Could decisions made when knowing costs of production by enterprise and after having examined a projected cash flow budget lead to more profit? Or can having and executing a written marketing and risk management plan bring financial value to the operation?

While the Kentucky study does show correlation between financial performance and Business IQ scores, it does not prove causation. Still, I believe business decisions are best made when understanding the true financial condition of the operation and the impact that pending decisions can have on that financial condition. At a minimum, removing some of the uncertainty of the decision can bring greater peace of mind. None of the decisions the farm business manager makes—marketing decisions, risk management decisions, investment decisions, tax decisions, etc.—should be made in isolation one-from-another. The Center for Agricultural Profitability continues to develop and add decision modules to their Agricultural Budget Calculator (ABC) that can assist producers in determining total costs of production and breakeven points for each enterprise, conduct sensitivity analysis and develop cash flow budgets, marketing plans and risk management plans. Check it out at cap.unl.edu/abc.

References

Shockley, J. and B. Isaacs. “Business IQ Analysis.” AEC 395, University of Kentucky. December 1, 2020.