The price difference between steers and heifers has long been a focal point for cattle market analysts, cow/calf producers, feedlot operators, and other industry stakeholders, providing insights into market trends, herd expansion, and feeder cattle demand. Herd expansion remains a lingering question and a topic of ongoing debate in 2025. Current industry headwinds, unlike those of previous cyclical shifts, are becoming increasingly relevant as the industry continues to define the trough of the ongoing cyclical contraction. Amid various confounding factors, revisiting the steer-heifer differential provides important clarity in reevaluating this question.

Heifer calves are typically discounted relative to their steer contemporaries due to their growth variability, reduced feeding efficiency, and tendency to finish at lower weights. The differences in performance justify the premium for steer calves. The discount fluctuates based on the total supply of feeder cattle available for placement in feedlots, the demand for heifers as replacement cattle — both influenced by the cattle cycle and seasonality — and can also vary across weight classes. The price disparity typically widens during the contractionary phase of the cattle cycle due to a surplus of females entering the market instead of being retained as potential breeding stock.

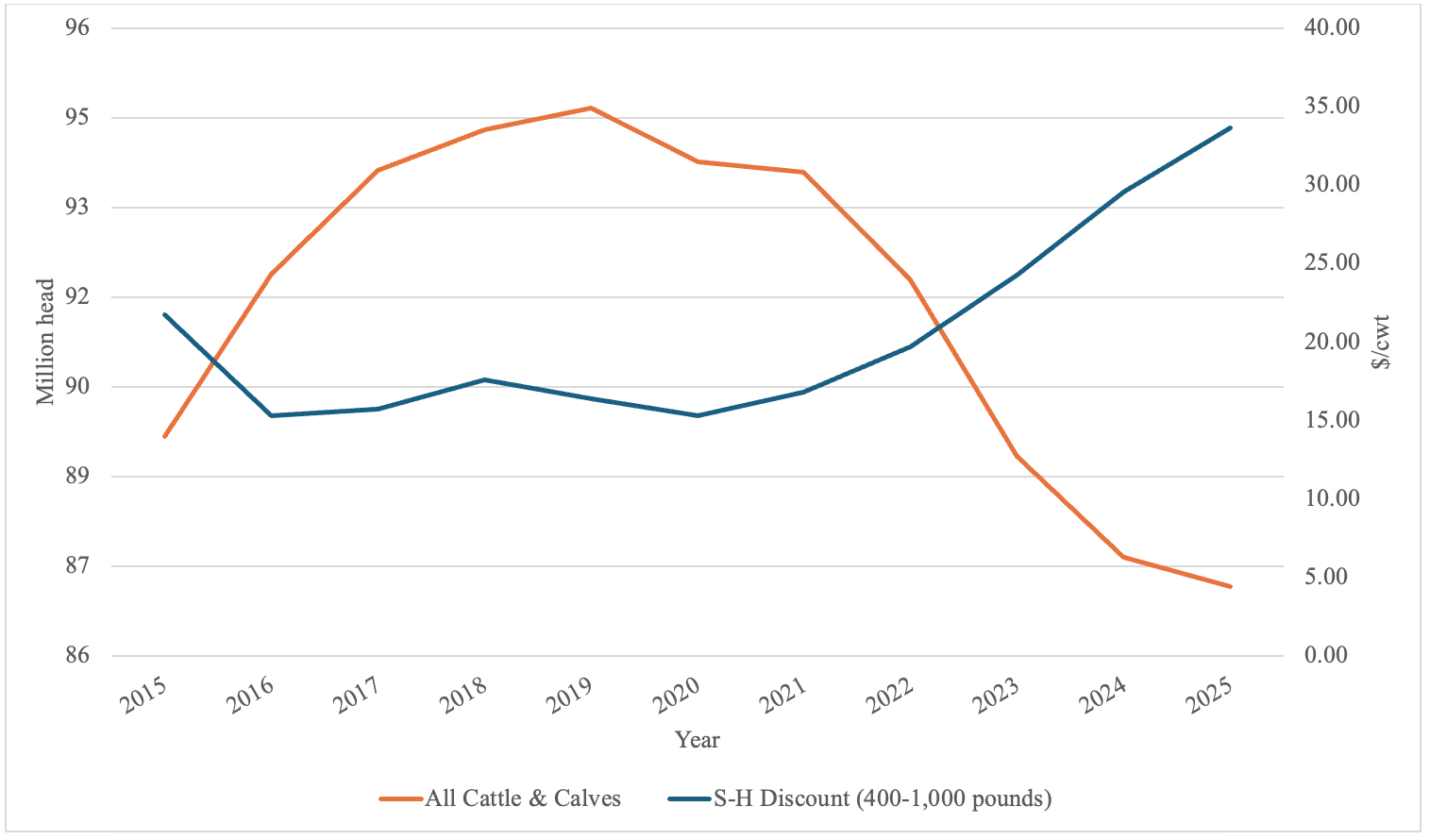

In the transition toward cyclical expansion, heifer discounts typically peak as producers retain females to rebuild herd inventory, thus tightening market supply. The difference is magnified when feeder cattle prices rise, with steer prices increasing faster than heifer prices. Through 2024, Nebraska steer and heifer prices across weight classes (400 to 1,000 pounds) increased 15% and 14%, respectively. However, the price difference between steers and heifers widened by 18%, rising from $27.81/cwt to $32.88/cwt. Although a number of other factors influence the start of herd expansion, larger heifer discounts act as a market signal, incentivizing retention.

In Nebraska, the steer-heifer differential across weight classes (400 to 1,000 pounds) in 2024 was 140% of the 5-year average and 154% of the 10-year average. Across 2024, the discount averaged to $29.53 per hundredweight, up from the previous year by $5.28 per hundredweight. The price difference was greatest in the lower weight classes, at $42.82 per hundredweight for 400-to-500-pound cattle, and decreased as weight increased. Compared to the equivalent stage of the previous cattle cycle, heifer discounts peaked at $21.72 per hundredweight in 2015, the year following inventory lows. By this point, heifers accounted for 33% of cattle on feed (2015 average), and the transition towards expansion was well underway.

Thus far, the current cattle cycle has proven to be uncharacteristic of those previously observed. Notably, the impact of reduced fed cattle and cow slaughter on downstream beef prices has been mitigated by significant increases in fed carcass weights. In 2024, carcass weights averaged 896 pounds, a 20-pound increase year-over-year, yet total beef production was only marginally lower. Weights have trended upward for several decades, but the sharp increase observed last year was largely driven by longer days on feed. A heifer’s lower finishing weight, combined with the shifting preference for heavier carcass weights, was likely a contributing factor to the increased steer-heifer differential.

The recent approval by the Food and Drug Administration of Elanco’s Experior feed additive, to be fed in combination with Melengestrol acetate (MGA) (i.e. a synthetic hormone commonly used as a feed additive to suppress estrus in finishing heifers), could shift the industry’s perception of the value placed on heifers. Experior, a beta-agonist and repartitioning agent, is labeled for reducing ammonia gas emissions per pound of live weight and hot carcass weight but has also been proven to increase hot carcass weight. Modified feeding strategies, combined with incentives to finish cattle at heavier weights, may prompt the industry to reassess the current market valuation of heifer calves intended for feedlot placement.

The steer-heifer differential observed in 2024 was historically large compared to the previous 10 years, partly due to the magnitude of price levels across all weight classes for both steers and heifers. From the previous cyclical transition, we know that the steer-heifer discount peaked in the year following cattle and calf inventory lows. It is unclear whether 2025 will mirror 2014, but current feedlot heifer inventory suggests that the steer-heifer price difference will continue to widen in the coming year.

Figure 1. U.S. Cattle & Calf Inventory (January 1) vs Nebraska Steer-Heifer Price Difference (400-1000 pounds)

Source: USDA-LMIC, Authors calculations

Table 1. Nebraska Steer-Heifer Price and Percentage Difference by Weight Class (2015-2024)

Source: Authors calculations using data from USDA compiled by LMIC.

| Weight Class | Steer-Heifer Difference by Weight Class | |||||

Price Difference ($/cwt) | Percentage Difference (%) | |||||

10-year average | 5-year average | 2024 | 10-year average | 5-year average | 2024 | |

| 400-500 | 28.56 | 31.35 | 42.82 | 12.39 | 12.51 | 11.76 |

| 500-600 | 24.14 | 25.99 | 35.09 | 11.44 | 11.29 | 10.67 |

| 600-700 | 20.45 | 22.41 | 31.47 | 10.44 | 10.49 | 10.57 |

| 700-800 | 16.50 | 18.04 | 26.45 | 8.99 | 9.02 | 9.74 |

| 800-900 | 13.24 | 14.85 | 21.14 | 7.65 | 7.88 | 8.35 |

| 900-1000 | 12.44 | 14.00 | 20.20 | 7.51 | 7.77 | 8.43 |

Listen: Nebraska FARMcast

TaraLee Hudson and Elliott Dennis discuss the latest trends and implications of prices differences between steers and heifers.