Pexels.

This article was originally published in the March 2022 edition of "RightRisk News" and is reposted here with permission.

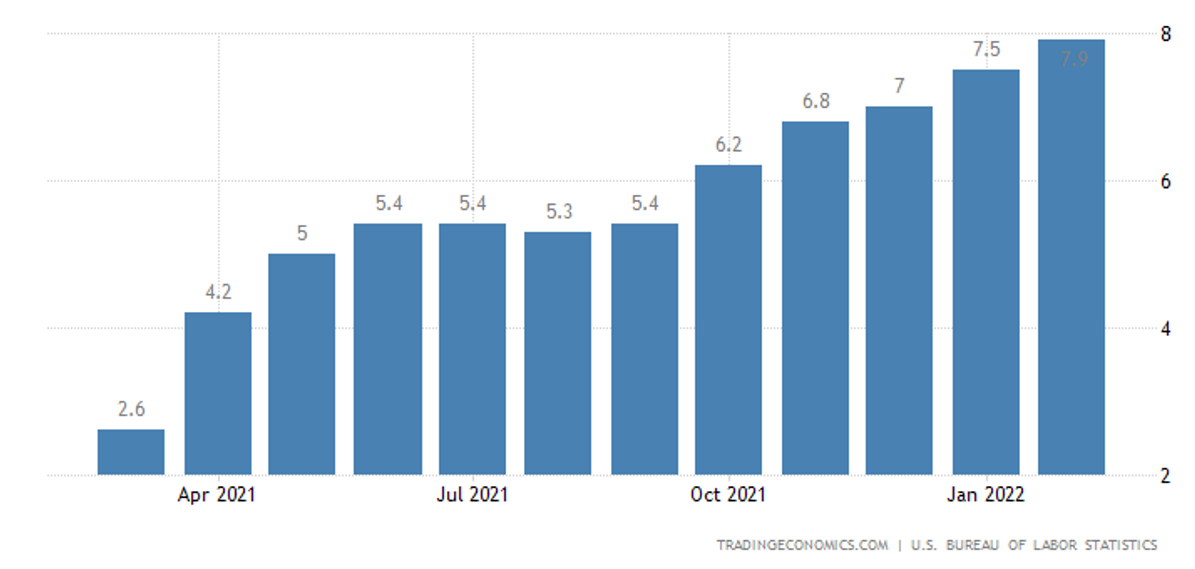

The term "inflation" has received a lot of attention lately. The U.S. Bureau of Labor Statistics on March 10 announced the annual inflation rate in the U.S. has accelerated to 7.9% as of the end of February. This is the highest annual inflation rate recorded since January 1982. Just as important is how quickly inflation has accelerated since the beginning of 2021 (Figure 1).

Figure 1: U.S. Annual Inflation Rate Over the 12-month period from March 2021 – February 2022.

What is inflation?

Inflation is defined in economics as an increase in prices over time that causes a reduction in the purchasing power of money. As such, inflation rates are tied to a specific currency and a specific bundle of goods purchased. The inflation rate reported by the U.S. Bureau of Labor Statistics depicted in Figure 1 is based on the U.S. Consumer Price Index for all urban consumers (CPI-U). The bundle of goods and services making up the CPI-U includes food, beverages, energy, shelter, medical care, vehicle purchases and expenses, transportation services, apparel, and tobacco products. It is intended to represent typical expenditures for the 93% of the total U.S. population residing in urban or metropolitan areas.

It is possible for certain countries to struggle with high inflation while others do not at any given point in time because inflation rates are tied to a specific currency. For example, in 2008 the country of Zimbabwe experienced one of the worst cases of hyperinflation ever recorded. The annual inflation rate in Zimbabwe at one point was estimated to be 500 billion percent! This led Zimbabwe to implement drastic measures and give up their national currency. The country now relies on several foreign currencies to carry out monetary transactions, including the U.S. dollar.

Inflation at its core is driven by supply and demand. Each person seeking to purchase goods and services has a limited supply of money to complete transactions. Demand for goods and services increases when the supply of money increases. An imbalance between the demand for goods and services and the ability to produce them causes what is called demand-pull inflation.

How is inflation managed?

Monetary policy can have a significant influence on the level of the demand-pull effect. Most economists believe that low, stable inflation is good for the economy. Deflation is viewed as bad for the economy where consumers delay purchases, thinking prices will decrease in the near future. This can create a downward spiral of economic activity that makes it difficult for anyone to achieve economic prosperity. Low interest rates are one monetary policy tool used to stimulate economic activity and avoid deflation. The ability to borrow money at low interest rates increases the money supply available to make purchases.

We have seen significant increases in the U.S. money supply with the recent COVID-19 relief packages. This, coupled with low interest rates and interruptions in the supply chains due to various reasons, has resulted in an imbalance in the supply of goods and services and the demand to purchase them. The steady rise in inflation over the past 12 months is not a surprise. It would have been more surprising had it not occurred. The Federal Reserve (FED) has the option to increase interest rates with the goal of managing inflation. The FED has hinted several times it was prepared to do so before finally doing it in mid-March. We should expect additional interest rate increases to occur in the near future as the FED seeks to bring the money supply and demand for goods and services supplied back into balance. The result should be a return to a low, stable inflation rate of 2 percent targeted by FED monetary policy.

Why should I worry about inflation?

Agriculture has experienced many nuances of inflation over the years. The boom years of the 1970s resulted in expanded production that was followed by the farm crisis of the 1980s, where high interest rates were used to bring down high inflation rates. Low commodity prices, high input costs and borrowing expenses left many producers unable to meet financial obligations.

Most economists do not expect the current situation to result in another farm crisis like that of the 1980s. Still, there is much to be aware of as you make decisions in the coming months. First, expectations play a key role in shaping inflation. People anticipating higher prices tend to bid up the market in anticipation of those future price increases. In addition, owners of assets affected by inflation benefit from its effects. For example, agricultural land prices have surged considerably in the last 12 months. Those who own land will benefit from this capital appreciation. However, those looking to purchase or rent land will see these inflationary pressures already capitalized into prices.

Inflationary periods tend to last only a few years. The most recent, prolonged period of inflation above 5% in the U.S. lasted from 1973-1982. There has only been one year with inflation above 5% since then (1990) and only one four-year period (1988-91) when inflation was above 4% for more than one year.

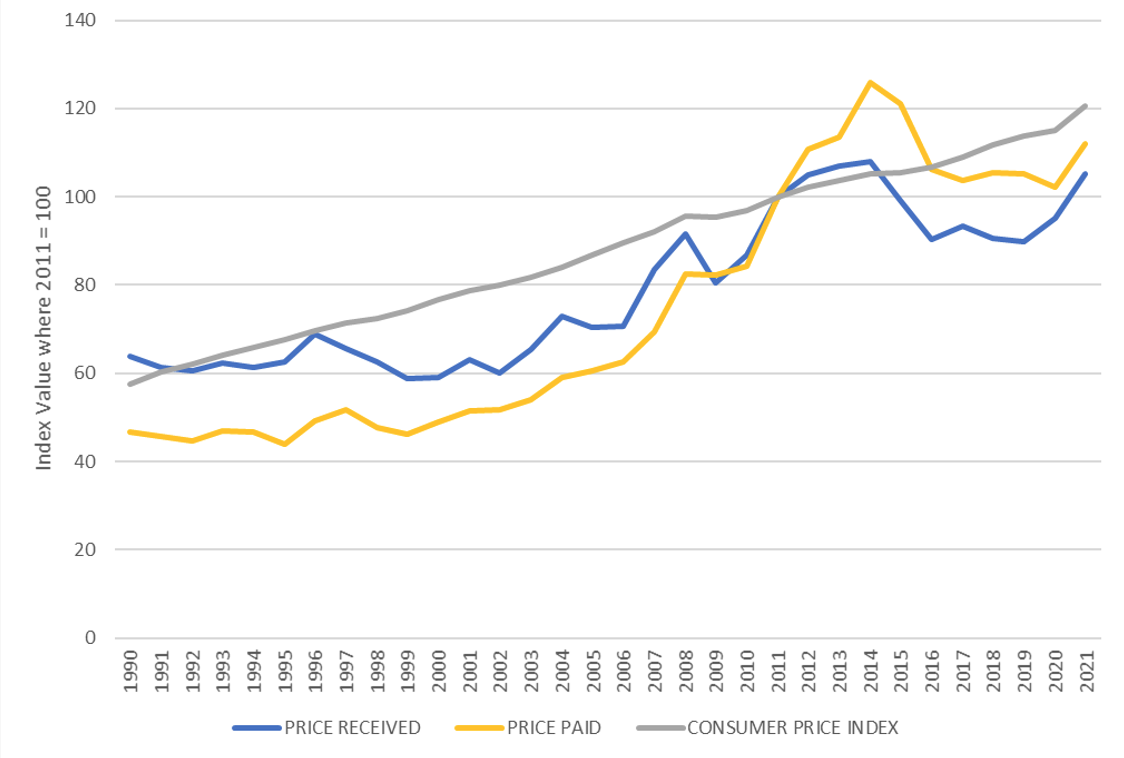

Commodity prices tend to rise with inflation but so do the prices paid for inputs. Figure 2 shows farm prices paid, farm prices received, and the Consumer Price Index (CPI) over the last three decades; the prices are indexed to 2011. We can interpret the lowest series on the graph prior to 2011 and highest after 2011 to be the price series with the most annual change. As such, prices received by producers kept up with or exceeded the CPI from 1991 to 2014. However, prices paid by producers for inputs more than canceled this out. Sustained economic viability of farms as a result currently relies on national farm program payments and increases in farm productivity.

Figure 2: USDA Index of Farm Prices Received, Farm Prices Paid and the Consumer Price Index (CPI).

Source: USDA/NASS

Why can I do about inflation?

How long current inflationary conditions will persist is uncertain. However, we can predict with a high degree of certainty that it will eventually subside. It is important to make decisions consistent with strategic objectives and not allow current market volatility to blur our view of the future. Avoid purchasing depreciable assets at inflated prices. Consumable inputs should be purchased at prices and quantities that make sense given the value they add to production and your ability to protect profit margins. Assets that appreciate and benefit from inflationary pressures should only be sold if the sale is consistent with long term objectives.

Finally, it is important to keep up-to-date financial records and not overreact to short-term volatility. A robust set of financial performance benchmarks can provide a sound basis to evaluate rolling averages and historical ratios. These can help maintain your focus on continuous improvement and help calm your nerves during volatile times.

Jay Parsons is a professor and extension farm and ranch management specialist at the University of Nebraska-Lincoln. Email Jay Parsons.

John Hewlett is at the University of Wyoming. Email John Hewlett.

Jeffrey Tranel is at Colorado State University. Email Jeffrey Tranel.