USDA/Flickr.

As 2021 has illustrated, low precipitation or drought conditions regularly remind livestock producers dependent upon perennial grass production that one of their major risks is difficult to control. However, tools like the Pasture, Rangeland, Forage (PRF) insurance program, administered by the USDA Risk Management Agency (RMA), can help mitigate the financial impact of this risk on the producer’s bottom line. PRF is available for purchase from crop insurance agents with coverage available on a calendar year basis. The signup deadline for calendar year 2022 coverage is Dec. 1, 2021.

PRF insurance is a group insurance policy based on grids 0.25 degrees longitude by 0.25 degrees latitude. It uses precipitation data from the National Oceanic and Atmospheric Administration Climate Prediction Center (NOAA CPC), providing producers with the opportunity to insure 70% to 90% of the Expected Grid Index Precipitation across a series of two-month intervals dispersed throughout the calendar year. Premium subsidies range from 51% to 59%, depending upon the coverage level selected.

If precipitation falls below the insured coverage level, the producer receives an insurance indemnity payment for the productive value of the difference. For example, suppose a producer in Custer County, Nebraska, insured a thousand acres of grass at the county base productive value of $45.80 per acre at the 90% coverage level and distributes their coverage throughout the year as illustrated in Table 1. If the precipitation index turns out to be less than 90% of normal, then the producer indemnity calculation multiplies the index shortfall by the policy protection for that interval period. For May-June, this example calculates an indemnity payment of (90-52.4)*8,244 = $3,444. To date, this example has generated enough indemnity ($4.29 per acre) to cover the producer premium for the year ($3.96 per acre) with two intervals still to be determined (Sep-Oct and Nov-Dec).

Table 1. Sample PRF Protection Table: Pasture, Rangeland, Forage insurance protection sample for 2021 in Custer County grid ID 25622 on 1,000 acres of non-irrigated perennial grass at 100% productivity value and 90% coverage level and coverage dispersed throughout the year. NOTE: Sep-Oct and Nov-Dec Actual Index Values are still to be determined.

| Interval Covered | Percent Of Value | Policy Protection | Premium Rate Per $100 | Total Premium | Premium Subsidy | Producer Premium | Actual Index Value | Indemnity |

|---|---|---|---|---|---|---|---|---|

| Jan-Feb | 15 | $6,183 | 21.55 | $1,332 | $680 | $652 | 77.7 | $845 |

| Mar-Apr | 20 | $8,244 | 19.61 | $1,617 | $824 | $793 | 162.1 | $0 |

| May-Jun | 20 | $8,244 | 12.72 | $1,049 | $535 | $514 | 52.4 | $3,444 |

| Jul-Aug | 15 | $6,183 | 15.36 | $950 | $484 | $466 | 115.7 | $0 |

| Sep-Oct | 15 | $6,183 | 21.64 | $1,338 | $682 | $656 | TBD | TBD |

| Nov-Dec | 15 | $6,183 | 28.84 | $1,783 | $909 | $874 | TBD | TBD |

| Total | 100 | $41,220 | $8,069 | $4,115 | $3,955 | $4,289 | ||

| Per Acre | $41.22 | $8.07 | $4.11 | $3.96 | $4.29 |

In calendar year 2021, Nebraska producers insured a record 3.55 million acres with PRF insurance. The average number of acres covered per policy was 2,040, with an average producer premium per policy of $4,834, or $2.37 per acre. With actual index values yet to be determined for several coverage intervals, 79% of policies earning premiums in Nebraska have earned some indemnity payment. To date, the average indemnity per policy is $6,174, or $3.03 per acre. The producer loss ratio to date is 1.28, indicating for every $1 of producer premium, indemnity payments of $1.28 have accrued in 2021.

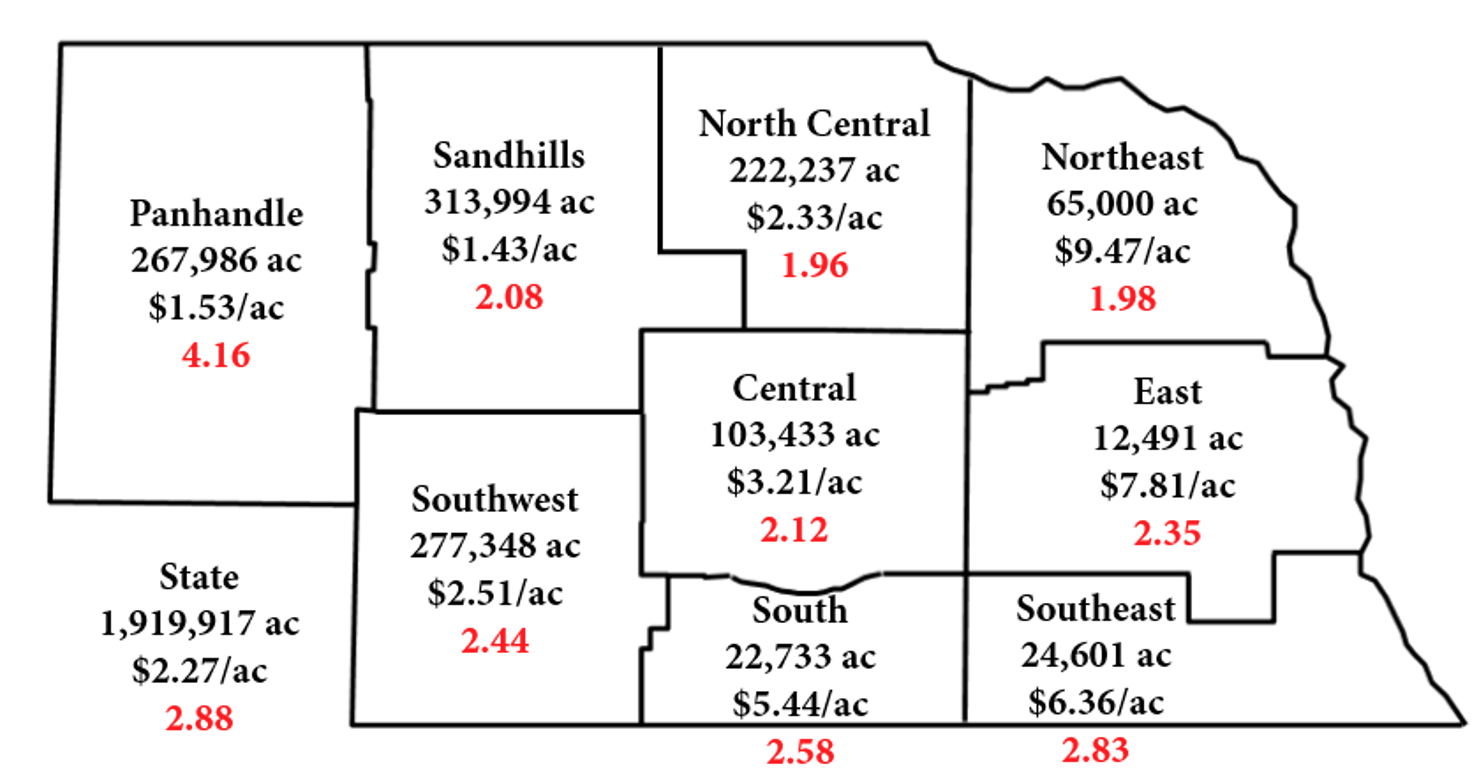

For the full calendar year of 2020, the producer loss ratio for the state was 2.88 (Figure 1). The producer loss ratio was higher for the Panhandle than it was for the other regions of the state but, overall, the producer loss ratios across the state for 2020 was quite high, as one would expect in a relatively dry year. However, results can obviously vary year to year. For example, the producer loss ratios for Nebraska in 2018 and 2019 were 0.44 and 0.60, respectively.

Figure 1: Nebraska PRF insured acres, average producer premium per acre, and producer loss ratios for 2020.

Source: USDA-RMA, Summary of Business.

With the Dec. 1 signup deadline date quickly approaching, producers interested in purchasing PRF for the 2022 calendar year should contact their crop insurance as soon as possible to begin the application process. For more information on PRF insurance visit: http://www.rma.usda.gov.

This material is based upon work supported by USDA/NIFA under Award Number 2018-70027-28586.