USDA/Flickr (Public Domain)

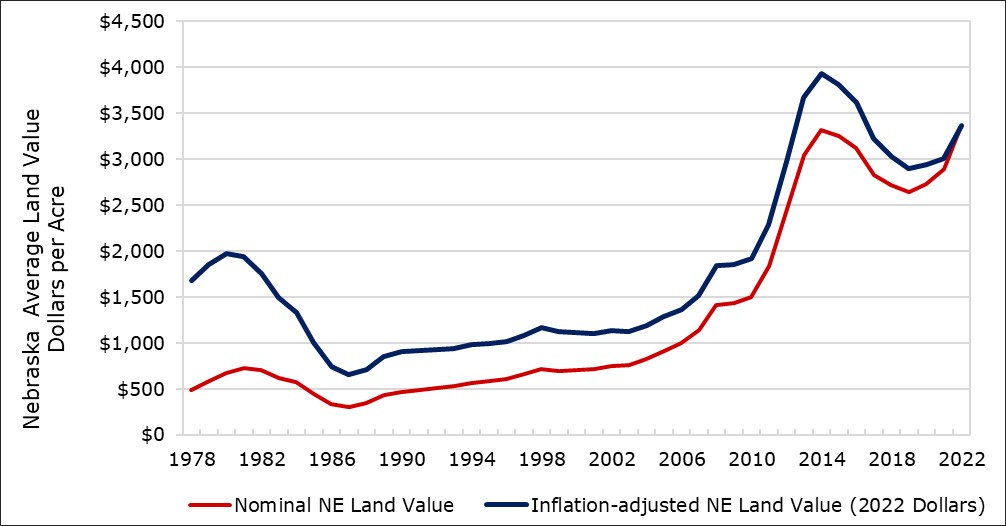

The market value of agricultural land in Nebraska increased by 16% over the prior year to an average of $3,360 per acre, according to the 2022 Nebraska Farm Real Estate Market Survey (Figure 1). This marks the largest increase in the market value of agricultural land in Nebraska since 2014 and is the highest non-inflation-adjusted (nominal) statewide land value in the history of the survey (Jansen & Stokes 2022).

Nominal statewide land values in Nebraska last reported double digit increases during the period from 2011 to 2013, which was marked by high energy prices and exceptional drought across major agricultural producing regions of the United States. These forces carried over into higher commodity prices and farm incomes. Farmers, ranchers, and investors capitalized these incomes into land purchases across Nebraska, translating into the prior statewide high of $3,315 per acre in 2014. Many of the economic forces surrounding the prior run-up in the market value of land are leading factors currently guiding real estate markets in late 2021 and 2022.

As part of the annual survey, responding land industry participants indicated that current commodity prices, interest rate levels, and a renewed interest in 1031 exchange purchases were leading factors contributing to the higher market values. Survey participants also reported land purchases as a hedge against future inflation. Concerns about inflation reached a 40-year high as the Consumer Price Index (CPI) reported a year-over-year inflation rate of 7.5% (BLS, 2022). Inflation rates have not been reported this high since the early 1980s when agricultural land markets experienced exceptional price fluctuations.

Historic land values in Nebraska may be adjusted for inflation by using the Gross Domestic Product (GDP) Price Deflator (BEA, 2022). In Figure 1, the inflation-adjusted Nebraska land value peaked in 2014 at an average of $3,926 per acre. The run-up and resulting decline in the market value of land in the 1980s are magnified even further by adjusting for inflation. One of the leading factors contributing to the decline in the market value of land during this period of time came from increases in interest rates on real estate loans. Many real estate loans were made under variable interest rate terms. Federal Reserve policies to combat inflation resulted in significantly higher interest payments on loans made under variable and fixed-term provisions.

Lending rates for different types of debt remained very favorable in 2021 for agricultural operations. The average interest rate on real estate debt for agricultural land loans averaged about 4.5% across states located in the Tenth District of the Federal Reserve Bank of Kansas City (Scott & Kreitman, 2022). Investors purchasing land using financing terms took advantages of these rates. The combination of favorable lending terms and higher operating income created robust market for real estate sales in Nebraska.

The outlook for real estate values in the land industry might be tied to changes in long-term interest rates, farm and ranch income, and availability of alternative investments. Renewed efforts by the Federal Reserve to combat inflation may lead to higher interest rates. Trade and drought patterns could lead to changes in crop or livestock prices and effect overall net farm income. Rising interest rates may make other investments more appealing compared to the low capitalization rates of land.

Figure 1. Nominal and Inflation Adjusted Historic Nebraska Average Land Value, Selected Years 1978-2022

Source: UNL Nebraska Farm Real Estate Market Development Survey, 1978-2022. Inflation adjusted value estimated by dividing the average value per acre by the 1st Quarter GDP Price Deflator (2022 = 100) and multiplying by 100.

Jim Jansen, (402) 261-7572

Agricultural Economist

University of Nebraska-Lincoln

jjansen4@unl.edu

Jeffrey Stokes, (402) 472-2127

Professor

University of Nebraska-Lincoln

jeffrey.stokes@unl.edu

References

Bureau of Economic Analysis. (2022, January 27). National Income and Product Accounts - Table 1.1.9. Implicit Price Deflators for Gross Domestic Product, retrieved March 21, 2022, from the U.S. Department of Commerce: https://apps.bea.gov/iTable/index_nipa.cfm.

Bureau of Labor Statistics. (2022, March 10). Consumer Price Index – February 2022, retrieved March 22, 2022, from the U.S. Department of Labor: https://www.bls.gov/bls/news-release/cpi.htm.

Jansen, J., & J. Stokes. (2022, March 16). 2022 Nebraska Farmland Values and Cash Rental Rates, retrieved March 21, 2022 from the Department of Agricultural Economics, University of Nebraska–Lincoln: https://agecon.unl.edu/2022-nebraska-farmland-values-and-cash-rental-rates.

Scott, F., & Kreitman, T. (2022, February 10). Rise in Farm Real Estate Values Accelerates, retrieved March 14, 2022, from the Kansas City FED: https://www.kansascityfed.org/agriculture/ag-credit-survey/rise-in-farm-real-estate-values-accelerates/.