Hailey Walmsley/realagstock

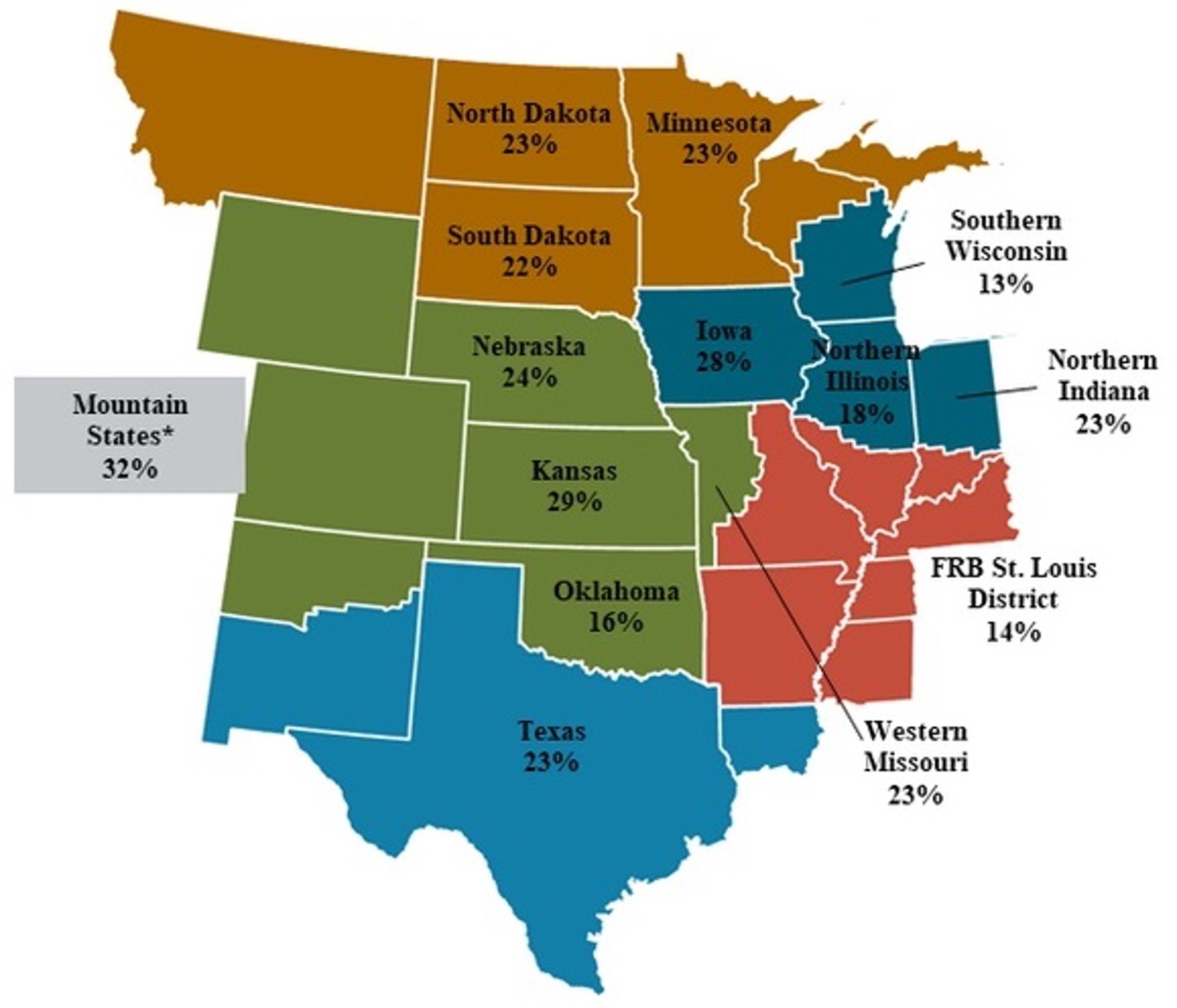

The Federal Reserve Bank of Kanas City recently reported the value of nonirrigated cropland in the central plains increased by more than 20% for the majority of the states in this region (Figure 1). The market value of nonirrigated cropland increased at the highest rate in the mountain states, at 32% (Kauffman & Kreitman, 2022a). Increases in the market value of land followed the rise in commodity prices for major crops grown across the central plains. Over the prior year, financing terms were also favorable for fixed-term interest rates. Policies implemented to combat the effects of COVID-19 on the economy lowered the cost borrowing for short- and long-term debt in the agricultural sector.

Figure 1. Average Value of Nonirrigated Cropland Values, First Quarter 2022 and Percent Change from Prior Year

*Mountain states include Colorado, northern New Mexico, and Wyoming.

Source: Strong Farm Economy Continues to Support Credit Conditions; N. Kauffman, & T. Kreitman, Federal Reserve Bank of Kansas City, May 19, 2022.

Disruption in global trade patterns, strong exports from the United States, and robust domestic demand were some of the major driving forces brining commodity prices back near record highs during the first half of 2022. Drought pressures in the western corn belt also remain a major concern. The U.S. drought monitor currently places almost 70% of Nebraska in moderate drought or worse (Riganti & Tinker, 2022). This concern also remains challenging for producers, as many critical inputs such as fuel, seed, fertilizer, or chemicals necessary for crop production were significantly higher than the prior year.

Different factors motivate the robust land market increase across the central plains beyond higher commodity prices. Operators took advantage of historically low interest rates and capitalized these values into real estate purchases. Inflationary pressures also placed a renewed interest in land purchases. Operators and investors purchased tangible assets as a hedge against rising inflation. The Bureau of Labor Statistics reported in June of 2022 that the Consumer Price Index (CPI) averaged 9.1% (BLS, 2022). This CPI measurement reflects the highest level of inflation in 41 years. Investors and agricultural operations look at land as an investment to hedge against inflationary pressure.

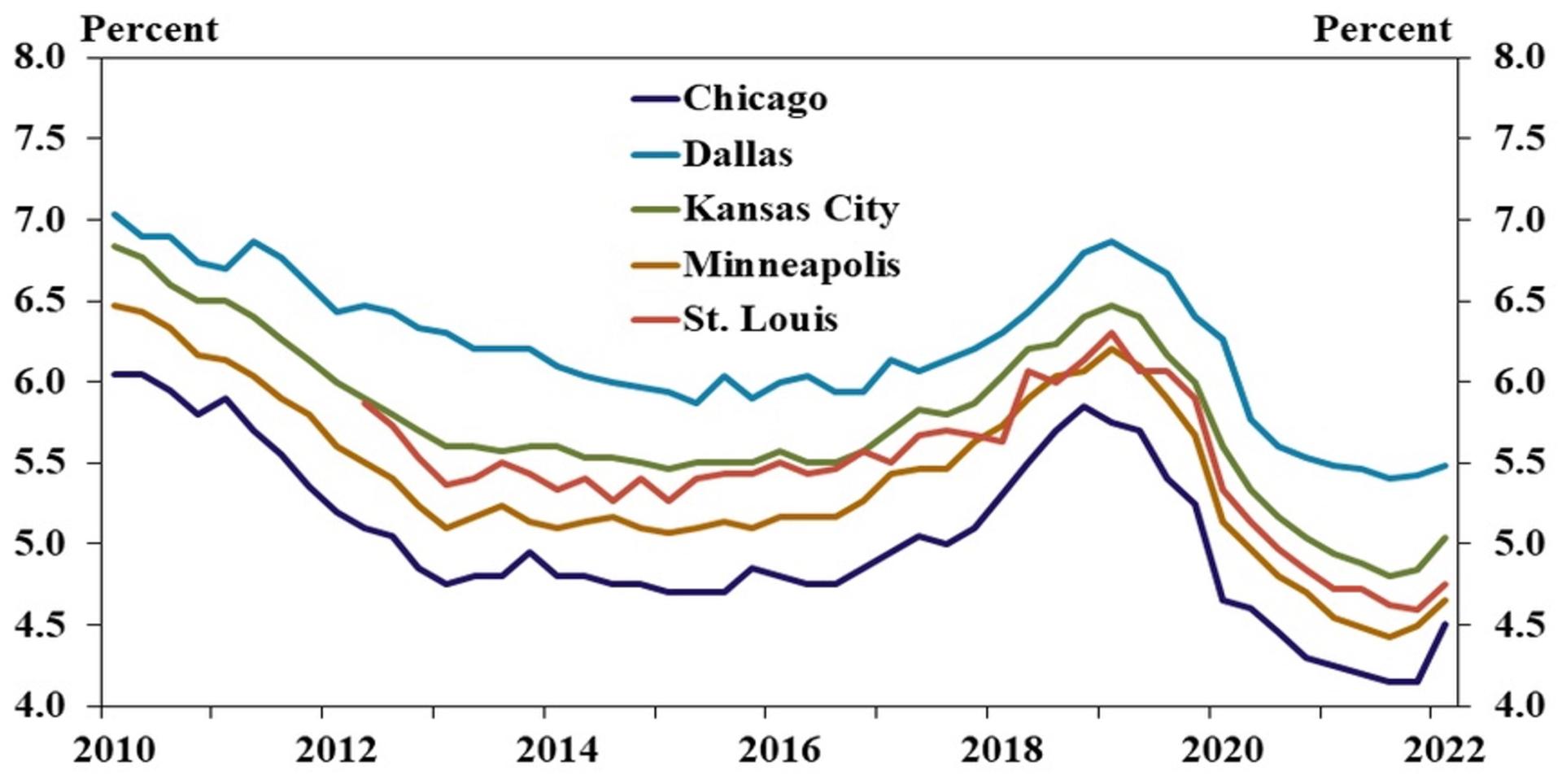

Interest rates for short- and long-term agricultural debt averaged from 4.5% to 5.5% in the central plains (Figure 2). The Federal Reserve Bank of Kansas City reported agricultural loans averaged around 5% in their region (Kauffman & Kreitman, 2022a). The cost of borrowing has also increased on long-term agricultural land loans. For example, advertisements for 30-year agricultural land loans currently average 6.2% for a fixed-term interest rate (FBN, 2022). Rates advertised a year ago averaged slightly less than 4% for the same type of agricultural land loan. A 2.2% increase in the interest rate substantially increases the cost of borrowing over the life of the loan.

Figure 2. Average Fixed Interest Rates for Agricultural Loans of All Types*

*Agricultural loans of all types include fixed rate debt for operating, intermediate, and real estate.

Source: Strong Farm Economy Continues to Support Credit Conditions; N. Kauffman, & T. Kreitman, Federal Reserve Bank of Kansas City, May 19, 2022.

The credit condition of many operations remains strong over the prior year. Along with higher commodity prices, rising real estate values have helped improve the financial position of many operators. Agricultural input expenses and drought conditions in major grazing land areas of the United States remains a challenge for operations (Kauffman & Kreitman, 2022b). The outlook for profitability in the agricultural sector may be tied to inputs such as seed, fertilizer, and chemicals, along with energy expenses. Improvements in supply chain issues and stabilization of energy markets may help alleviate rising farm input expenses.

References

BLS. (2022, July 13). Consumer Price Index – June 2022. Retrieved July 22, 2022, from The U.S. Department of Labor, Bureau of Labor Statistics: https://www.bls.gov/news.release/pdf/cpi.pdf.

FBN. (2022, July 21). Ag Land Loans from FBN Finance? Retrieved July 22, 2022, from Farmers Business Network: https://www.fbn.com/financing/land-loan.

FBN. (2021, June 4). How Much Could You Save On Your Farmland Loan? Retrieved June 7, 2021, from Farmers Business Network: https://use.fbn.com/calculate-your-farmland-savings.

Kauffman, N., & Kreitman, T. (2022, May 19). Strong Farm Economy Continues to Support Credit Conditions. Retrieved July 5, 2022, from the Federal Reserve Bank of Kansas City: https://www.kansascityfed.org/agriculture/agfinance-updates/strong-farm-economy-continues-support-credit-conditions/.

Kauffman, N., & Kreitman, T. (2022, May 12). Credit Conditions Remain Strong, but Outlook Softens. Retrieved May 12, 2022, from the Federal Reserve Bank of Kansas City: https://www.kansascityfed.org/agriculture/ag-credit-survey/credit-conditions-remain-strong-outlook-softens/.

Riganti, C., & Tinker, R. (2022, July 21). U.S. Drought Monitor. Retrieved Jul 22, 2022, from the National Drought Mitigation Center, University of Nebraska-Lincoln: https://droughtmonitor.unl.edu/.

Jim Jansen is an agricultural economist with Nebraska Extension. Jeff Stokes is the Hanson-Clegg-Allen Endowed Chair Agricultural Banking and Finance in the Department of Agricultural Economics.