USDA/Flickr

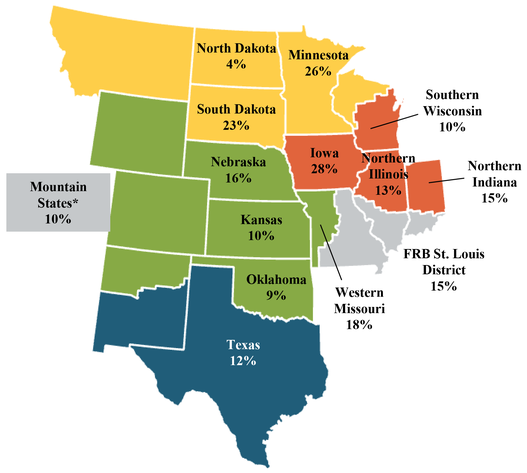

The Federal Reserve Bank of Kansas City recently reported that nonirrigated cropland values in the central United States increased by values between 9% to 28% for the third quarter of 2021 compared to the third quarter of 2020 (Figure 1). Iowa and Minnesota nonirrigated cropland values rose at the highest rates of 28% and 26%. Nonirrigated cropland values in Nebraska increased by 16% (Kauffman & Kreitman, 2021a). Historically low interest rates, coupled with strong farm income across operations, fueled the growth in farm real estate values. Concerns remain across operations in heightened input costs for crop production and other common farm or ranch expenses.

Despite the growth occurring across input expense, farm loan repayment improved over the prior year. Problem farm loan rates also declined in states located in the Tenth District of the Federal Reserve Bank of Kansas City (Kauffman & Kreitman, 2021b). Strong financial conditions have led to the increase in other agricultural asset classes. Prices for new and used agricultural equipment have risen rapidly with improved demand from operators. Manufacturers of agricultural equipment are facing production challenges with rising steel prices and labor rates. Many new agricultural equipment orders face extended wait periods due to exceptional demand and shortages in manufacturing.

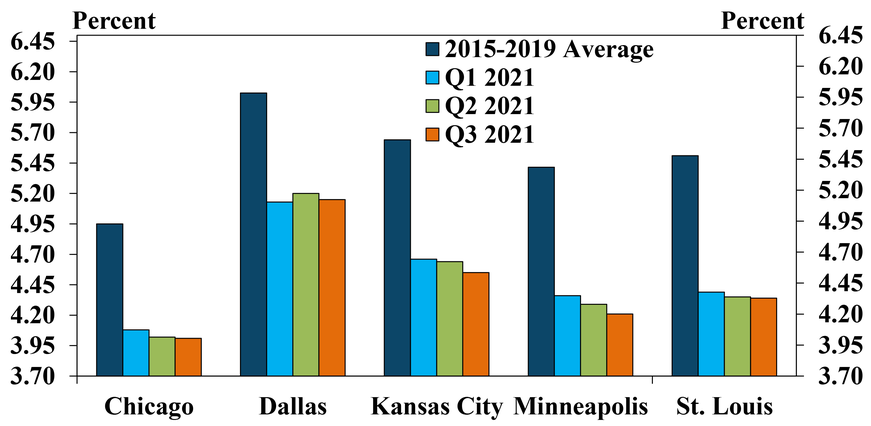

Historically low interest rates for fixed-term real estate loans set new lows during the third quarter of 2021 (Figure 2). Interest rates on real estate loans averaged about 100 basis points lower than the historic period between 2015 to 2019 (Kauffman & Kreitman, 2021a). Operators have taken advantage of these rates to secure long-term financing. Extended periods of low interest rate levels become capitalized into asset values such as agricultural land and equipment. During this period farms or ranches may consider refinancing existing debt to a lower fixed rate.

Investors and operators purchasing agricultural land may be looking at this asset as a hedge against inflation. Historically low interest rates coupled with strong farm income has been followed by inflation for consumer goods, industrial supplies, and agricultural inputs. Some of these price increases may be alleviated with improvements in supply chain bottlenecks, but concern still remains in the agricultural, industrial, and consumer sectors. The increased demand to acquire tangible assets may partially contribute to the robust prices paid for agricultural land and equipment.

The outlook for farm real estate values in 2022 may be tied to profitability and financial positions of agricultural operators. Financing remains a critical decision-making consideration when bidding up the value of agricultural real estate. Rising input costs erode profitability unless offset with higher commodity prices. Changes in commodity prices or interest rates may also impact the financial outlook for operators. Potential actions taken by the Federal Reserve to address inflation could lift long-term interest rates from historic lows. How these economic forces impact real estate values remains to be seen with the start of the new year.

Jim Jansen, (402) 261-7572

Agricultural Economist

University of Nebraska-Lincoln

jjansen4@unl.edu

Jeffrey Stokes, (402) 472-2127

Hanson-Clegg-Allen Endowed Chair

Agricultural Banking and Finance

University of Nebraska-Lincoln

jeffrey.stokes@unl.edu

References

Kauffman, N., & Kreitman, T. (2021, November 23). Farm Real Estate Values Rise Sharply. Retrieved December 7, 2021, from the Ag Finance Updates for the Federal Reserve Bank of Kansas City: https://www.kansascityfed.org/agriculture/agfinance-updates/farm-real-estate-values-rise-sharply/.

Kauffman, N., & Kreitman, T. (2021, November 15). Farmland Values Surge Alongside Strength in Agriculture. Retrieved December 8, 2021, from the Ag Credit Survey for the Federal Reserve Bank of Kansas City: https://www.kansascityfed.org/agriculture/ag-credit-survey/farmland-values-surge-alongside-strength-in-agriculture/.

Figure 1. Average Value of Nonirrigated Cropland Values, Third Quarter 2021 and Percent Change from Prior Year

*Mountain states include Colorado, northern New Mexico, and Wyoming.

Source: Farm Real Estate Values Rise Sharply; N. Kauffman, & T. Kreitman, Federal Reserve Bank of Kansas City, November 23, 2021.

Figure 2. Average Fixed Interest Rates for Farm Real Estate Loans

Source: Farm Real Estate Values Rise Sharply; N. Kauffman, & T. Kreitman, Federal Reserve Bank of Kansas City, November 23, 2021.