USDA/Flickr (Public Domain)

This article was first published by "Pork Talk" in March 2022.

Prices along the hog complex experienced by producers during 2021 have more than kept pace during the first few months of 2022. This article reviews prices along the pork complex during the first two and one-half months of 2022. It also provides some commentary about the supply and demand factors influencing market prices and whether producers should expect these prices to continue.

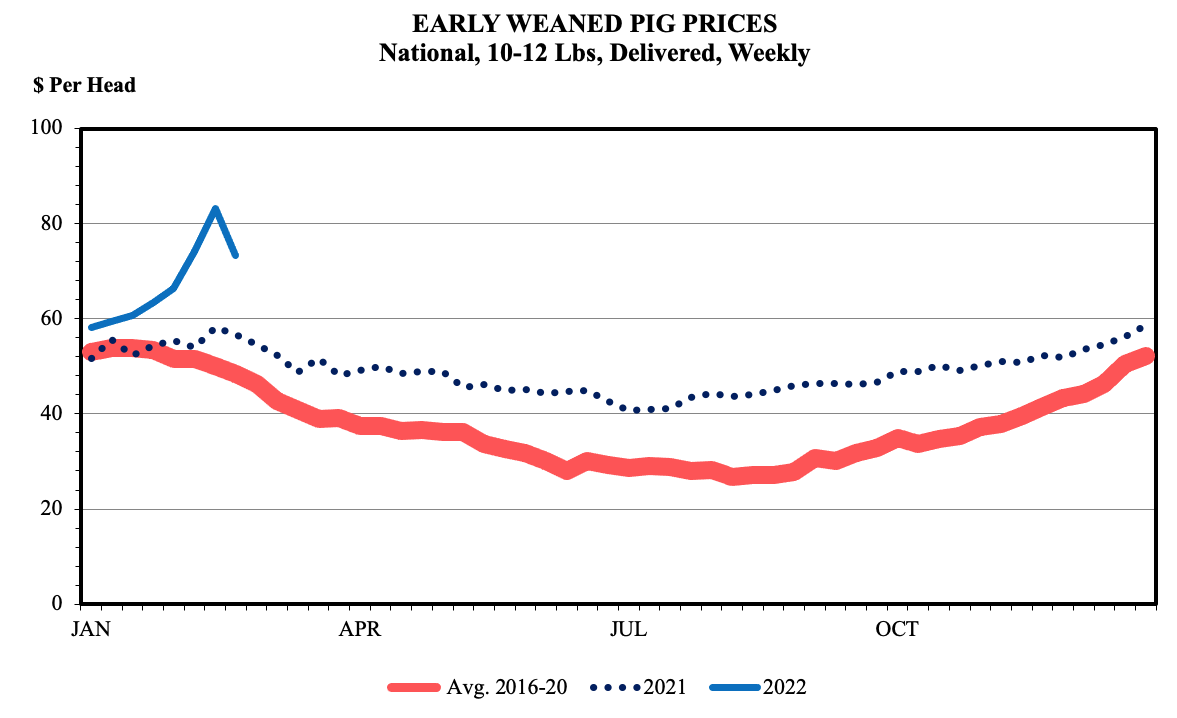

Early Weaned Pigs (10-12 lbs.)

Early weaned pig prices (10-12 pounds, delivered) are flat the first several weeks of the year before decreasing throughout the spring and summer beginning to rise in September. However, this year at the end of January and through most of February prices have risen. The 10–12-pound pig price began in January at $58.23 per head and peaked in the middle of February at $83.29. Prices have since come down to $73.33 per head. For perspective, these prices are higher than the $70 per head the market experienced in 2014 due to PEDv.

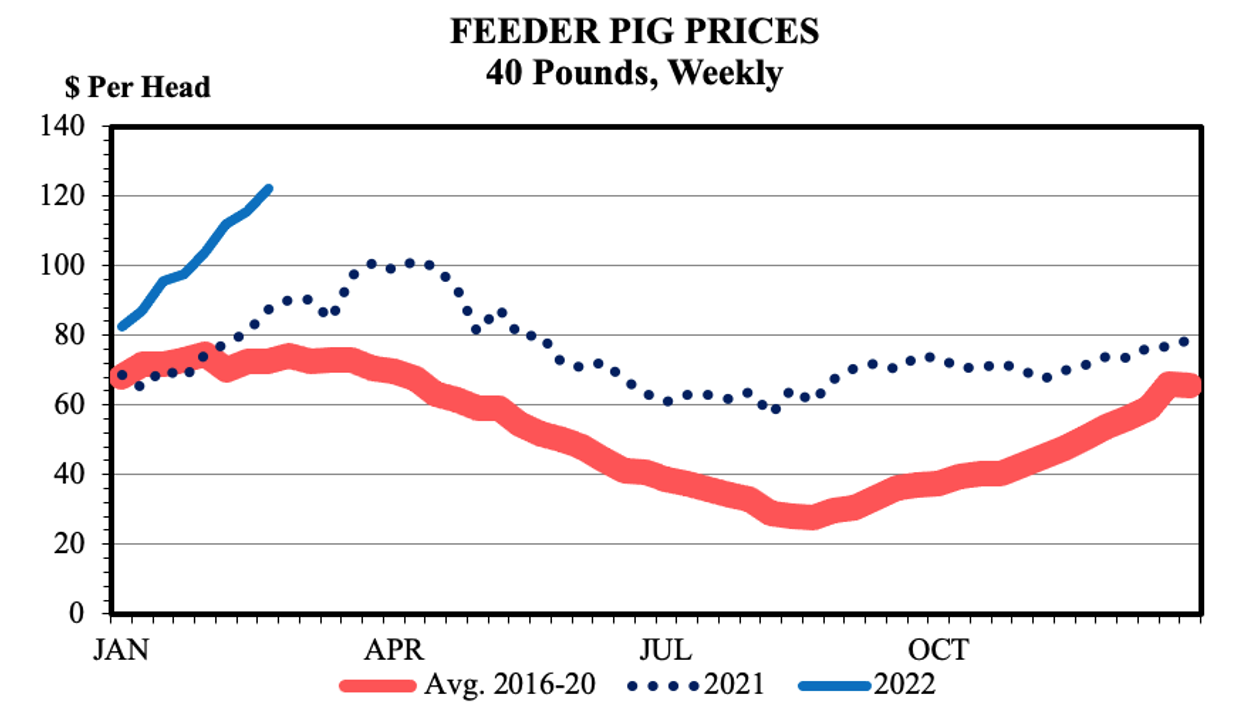

Feeder Pigs (40 lbs.)

Feeder pig prices (40 lbs.) are typically flat through the middle of March before declining to their low in August/September and rising through the late fall months. This year prices began at $82.43 and have continued to rise to $122.28 per head – equivalent to a 48.3% increase since the beginning of the year. While these price increases have been large, they are still below the record level of $139.14 per head set in April 2014 because of PEDv. If seasonal patterns hold and the price gains remain constant, prices could be in the range of $160 per head. However, what is more likely is that price gains begin to weaken and peak between $140-145 per head.

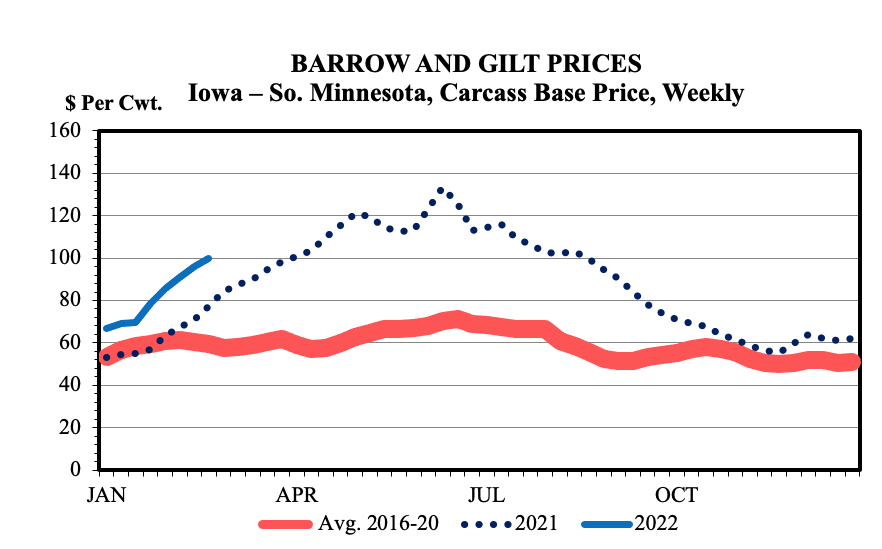

Barrow and Gilt

Barrow and gilt prices (carcass base) typically increase from January to June/July and then decline throughout the late summer and fall months. Before 2021, this seasonal increase was relatively narrow - typically a $15 per cwt. spread between the seasonal high and low price. In 2021, this price spread dramatically increased to $90 per cwt. Prices began this year at $66.69 per cwt. and have continued to rise to $99.71 per cwt. Although these prices are higher, the seasonal pattern seems to be closely following 2021. Weekly prices in 2022 are approximately $15 above the 2021 price. If this pattern continues to hold throughout the year, barrow and gilt prices (carcass base) could peak at just over $143 per cwt.

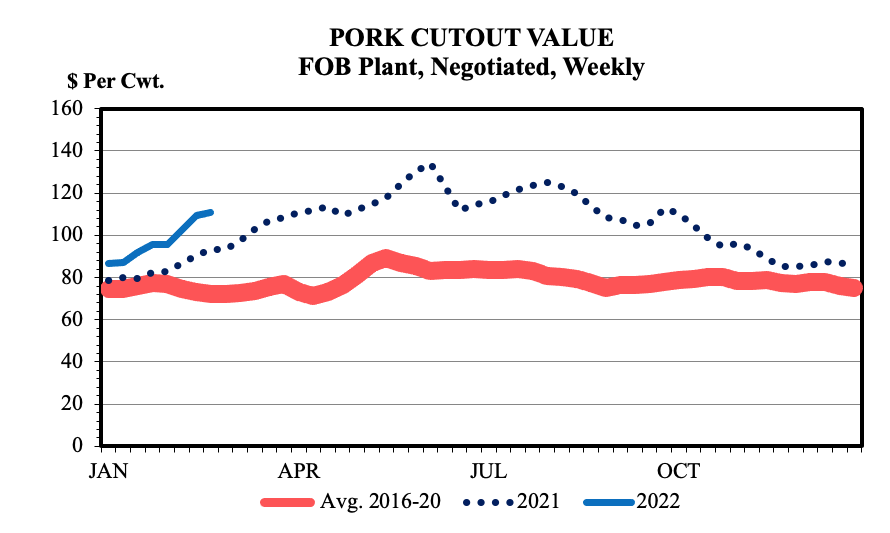

Pork Cutout

The pork cutout (FOB plant, negotiated) has a similar seasonal pattern to the barrow and gilt market – rises till June/July and then decreases the second half of the year. Similar to other markets, the increase in 2021 was significantly greater than the historical 5-year average. Prices in 2022 have likewise been elevated beginning the year at $86.57 per cwt., $12 per cwt. higher than the 5-year average. Prices have closely followed the seasonal patterns of 2021 with an added $13-17 per cwt. premium each week. If this price increase continues throughout the year, prices could peak at or near $150 per cwt.

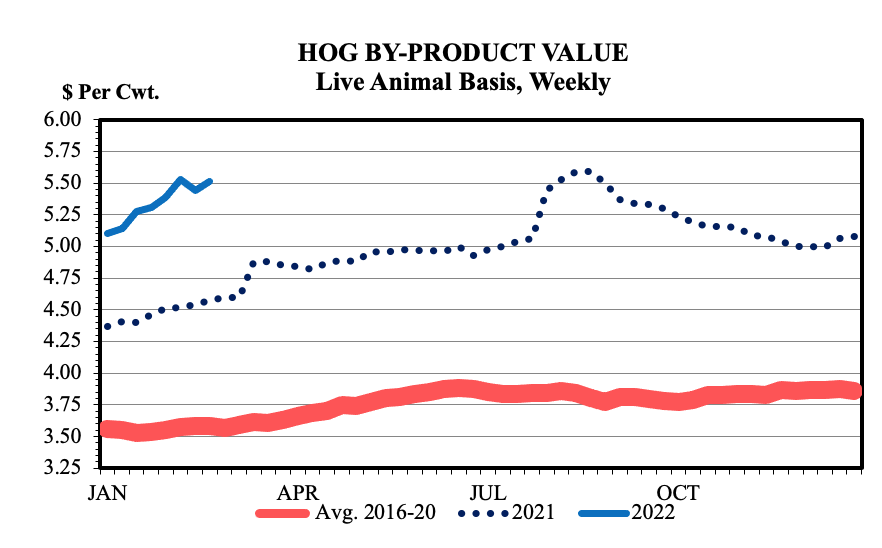

Hog By-Product

The hog byproduct value has been one of the real surprises in the hog complex. Since it is a residual product, its’ value generally rises and falls with the pork cutout – albeit its value tends to be steadier. For example, using average prices high product value represented approximately 6% of the pork cutout and 8% of the barrow and gilt price at the beginning of 2022. Its’ value, on a percentage basis, decreases throughout the summer and then rises again in the fall. There has not been a significant change in the demand for byproducts.

Support for Stronger Prices Moving Forward

Demand consists of both prices and quantities. In other words, demand is NOT per capita consumption. Domestic consumers have shown throughout 2020 and 2021 that they are willing to purchase pork even at elevated (inflated) prices. This is new territory for pork and other meat products. Consumer confidence is currently high but has shown signs of weakening due to concerns over inflation and the stability of the future economy.

Elevated domestic prices are partially the result of the reduced global supply of pork due to African Swine Fever (ASF) in both the wild and commercial herds throughout Asia and Europe. The U.S. processors have taken advantage of this by selling more into the export market which pulls more pork off domestic consumers raising domestic prices. For perspective, pork export demand has grown significantly since 1988. This demand has come through both the development of new trading partners and selling more products to existing partners. The U.S.’s two strongest trading partners remain Canada and the EU 28. Mexico has also gained importance since 2010. The domestic supply will also likely remain limited given recent farrowing intentions and elevated sow prices which will incentivize some producers to cycle out sows. This could potentially reduce the number of gilts harvested if they are held back for breeding. These factors will keep supplies tight throughout the year – similar conditions to those experienced in 2021.

Given these supply and demand factors, market prices have the potential to trend higher through the end of March and the beginning of April across the hog complex. Prices should follow their seasonal pattern as there is currently no indication that market factors will cause prices to deviate from their seasonal patterns.