Visual Stories | Micheile (Unsplash)

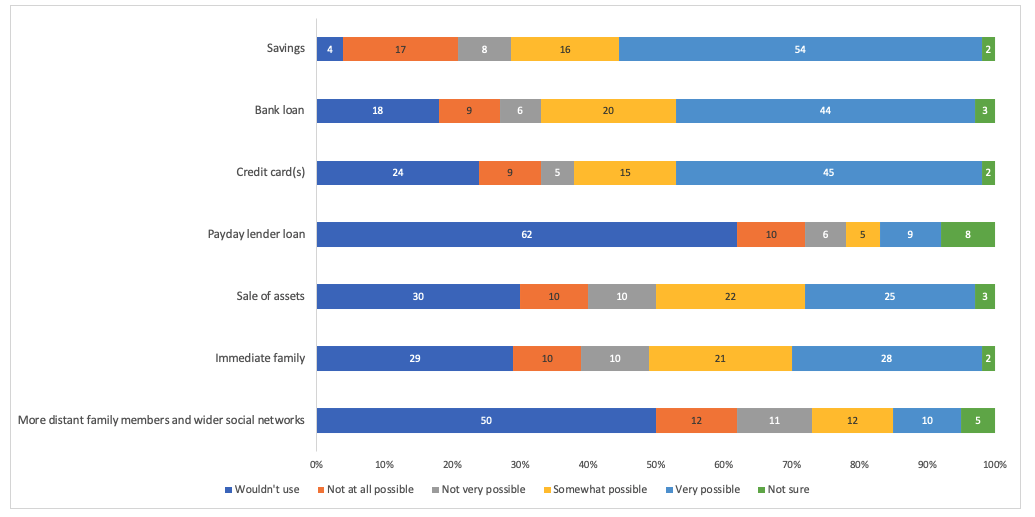

Different types of resilience were explored in the 2020 Nebraska Rural Poll, including the financial resilience of respondents. To measure this, respondents were asked how possible it would be for their household to access various sources to come up with $3,000 in the next month to deal with an emergency. Savings, credit card(s) and a bank loan were the most accessible sources of emergency funds for rural Nebraskans. A slight majority of rural Nebraskans (54%) stated it would be very possible to access savings to come up with $3,000 in emergency funds in the next month. Many rural Nebraskans (45%) said they could access credit card(s) and a similar percentage (44%) said they could use a bank loan to come up with emergency funds. Most rural Nebraskans said they wouldn’t use a payday lender loan (62%) or more distant family members/wider social network (50%).

The availability of savings to cover an emergency can shed some light on the financial resilience of certain rural Nebraskans. Some groups of respondents were less prepared to handle a financial emergency, including those with a household income less than $40,000, those who were divorced or separated, and those who worked in food service or personal care occupations. Approximately three in 10 respondents from each of those groups said it would not be possible to use savings to cover a $3,000 emergency.

Conversely, persons with higher household incomes, younger persons, males, married persons, persons with higher education levels and persons with occupations in agriculture were the groups most likely to say it would be very possible to use savings to cover an emergency. Almost eight in ten persons with household incomes of $100,000 (77%) or more said it would be very possible to use savings to cover a $3,000 emergency. Almost seven in ten persons with at least a four-year college degree (69%) said it would be very possible to cover a $3,000 emergency with savings and over six in ten persons with occupations in agriculture (63%) could access savings to cover such an emergency.

Being able to access a bank loan to help cover an emergency can also help determine how financially resilient certain groups are. Again, persons with higher household incomes are more likely than persons with lower incomes to say it would be possible to access a bank loan to cover a $3,000 emergency. Over one-half of persons with household incomes of $75,000 or more say it would be very possible to use a bank loan to cover an emergency, compared to just under one-quarter (23%) of persons with household incomes under $40,000. And, education is again a factor in financial resilience. Just over one-half (51%) of persons with at least a four-year college degree said it would be very possible to access a bank loan to cover an emergency, compared to just over one-third (35%) of persons with a high school diploma or less education. The other groups most likely to say it would be possible to use a bank loan to cover a $3,000 emergency include persons age 40 to 64 and married persons.

These data give a better understanding of the financial well-being of rural Nebraskans. Most respondents appear to be poised to handle emergency expenses, with most having savings available to cover a financial emergency. In addition, many think it would be possible to access a bank loan or credit card(s) to handle an emergency. Both of these sources require a good credit rating, which can further attest to their financial resilience. However, certain groups of respondents would have a harder time accessing these sources to cover an emergency.