It’s the beginning of the month, and last month’s bank statement arrives. What do you do with it? If it goes directly into your filing cabinet, you are missing an important step in the bookkeeping process – reconciling. Reconciling is the process of making sure one record of a financial account is consistent with another. For most farms and ranches, this act usually takes place between the bank statement and the checkbook register or financial accounting software such as Quicken or QuickBooks.

The first step to the reconciliation process is to gather documentation including your bank statement, deposit slips, receipts, and invoices for the previous month as well as your checkbook, and a reconciliation worksheet (download example here. Note that some banks will print a reconciliation worksheet on your bank statement.

Start by reviewing each transaction on the bank statement for accuracy against the respective deposit slip, receipt, or invoice. Is the amount of each transaction, correct? If your bank made an error, you need to notify them of the mistake.

You may also find through this process that your bank statement shows transactions that have not been recorded in your check register or financial accounting software. You will need to make new entries for these missing transactions. Most often missing transactions include service fees, interest deposits and automatic transfers.

Repeat the review process with your check register or financial management software. Evaluate each entry for accuracy. If you find an inaccurate transaction in your check register, you will need to write in a correction entry. In most accounting software, you should be able to update the amount of the debit or credit.

During this review process of your check register denote what checks and deposits that appear on the bank statement. Most check registers have a column that allows you to write in a checkmark to signify that the transaction has cleared.

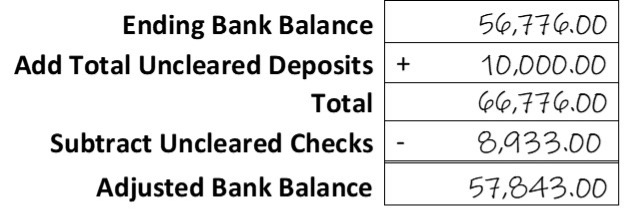

Through this process you might identify uncleared checks and deposits. An uncleared or outstanding transaction is a check or deposit that has not yet been recognized by the bank. On the reconciliation worksheet add the uncleared deposits to the ending bank balance or subtract the uncleared checks.

At the end of this process, the adjusted bank balance on the reconciliation worksheet should match your check register or financial software balance. You should file a reconciliation worksheet with your bank statement.

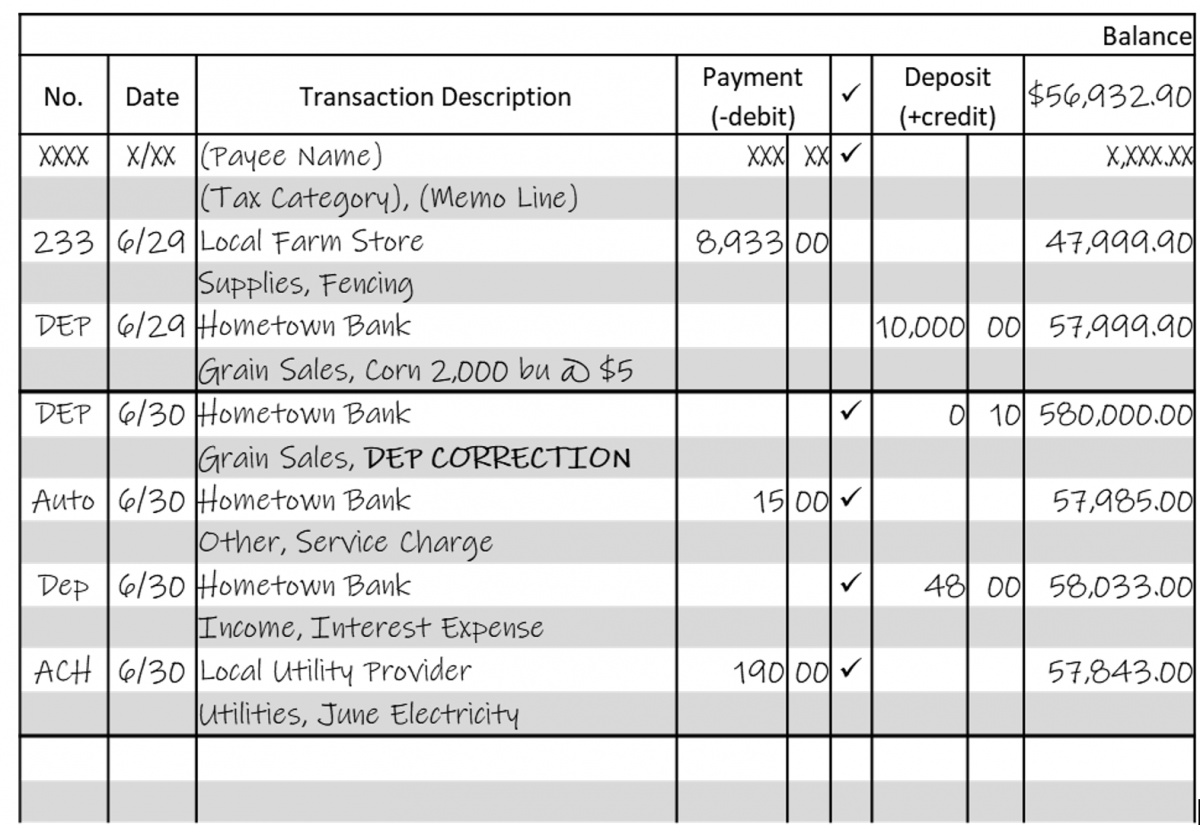

Bank Statement Reconciliation Example: Jon & Joan received their June bank statement for “Case Farm” and must prepare a bank reconciliation for the following items. The bank statement contains an ending balance of $56,776.00 on June 30th, whereas the Farm check register shows an ending balance of $57,999.90.

They found the following discrepancies between their bank statement and check register.

- Jon incorrectly recorded a deposit on June 5. The correct deposit amount was $11,011.10. It was recorded as $11,011.00.

- The bank statement shows a service charge of $15.

- The bank statement shows interest income of $48.

- On June 29th, Case Farms issued check #233 for $8,933 that has not yet cleared the bank.

- On June 29th, Case Farms also deposited $10,000 but this did not appear on the bank statement.

- An Automatic Clearing House (ACH) payment for electricity was paid from the bank account for $190.

On the reconciliation worksheet, Jon & Joan had to credit the account for the outstanding deposit and debit the account for the uncleared check as shown below.

In the check register below, the entries on June 30 were created during the reconciliation process. Jon & Joan had to credit the account for the $0.10 from the June 5 deposit and the interest earned on their account. They had to record debits for the service fee and ACH transaction.

Now, the “adjusted bank balance” on the reconciliation worksheet is equal to the balance shown in the check register of $57,843.00.